Image: SoftBank Group

In the middle of its worst financial quarter ever, it's encouraging to know that Japanese tech conglomerate SoftBank refuses to stop using silly and absurd slides in earnings presentations.SoftBank recorded an eye-watering $9 billion loss from March 2019 to 2020, while its $100 billion Vision Fund lost $17.7 billion, $10 billion of that since January alone. With $13.4 billion in gains and $14.2 billion in losses, the fund is $800 million underwater and yielded investors an internal rate of return of -1 percent on the $81 million it has invested so far.Gone are the days of SoftBank CEO and founder Masayoshi Son’s “300-year plan” to revolutionize human civilization by using capital as a weapon and creating countless monopolies across every industry possible. Son is expected to get serious now and is being pressured by vulture capitalists like Elliot Management to sell $41 billion in assets for stock buybacks that'll inflate its finances. Some of the first options are its ~25 percent stake in T-Mobile, along with its 26 percent stake in Alibaba (currently valued north of $129 billion)—SoftBank leveraged its pre-existing investments to attract investors to the Vision Fund.And yet, with all this money being thrown around, there is one place SoftBank has always pinched pennies: its graphic design. The company has never been able to stop using absurd slides in otherwise depressing and embarrassingly bad earnings reports. Who can forget how all these NEW technologies like online shopping and food delivery were invented. Perhaps SoftBank is referring to how it has innovated creatively efficient ways for investors to lose money backing firms that claim to use these technologies, but who knows?

Who can forget how all these NEW technologies like online shopping and food delivery were invented. Perhaps SoftBank is referring to how it has innovated creatively efficient ways for investors to lose money backing firms that claim to use these technologies, but who knows? SoftBank loves this idea of “happiness for everyone” and consistently uses slides with groups of people smiling or using their tech. This is hard to reconcile with the reality faced by workers of crown jewel investments like Uber and DoorDash, where employees are intentionally misclassified as independent contractors to cut labor costs via subminimum wages, pushed to choose to work or starve during the pandemic, and frequently piss in bottles or sleep in cars since they are treated and regarded as second-class citizens.

SoftBank loves this idea of “happiness for everyone” and consistently uses slides with groups of people smiling or using their tech. This is hard to reconcile with the reality faced by workers of crown jewel investments like Uber and DoorDash, where employees are intentionally misclassified as independent contractors to cut labor costs via subminimum wages, pushed to choose to work or starve during the pandemic, and frequently piss in bottles or sleep in cars since they are treated and regarded as second-class citizens.

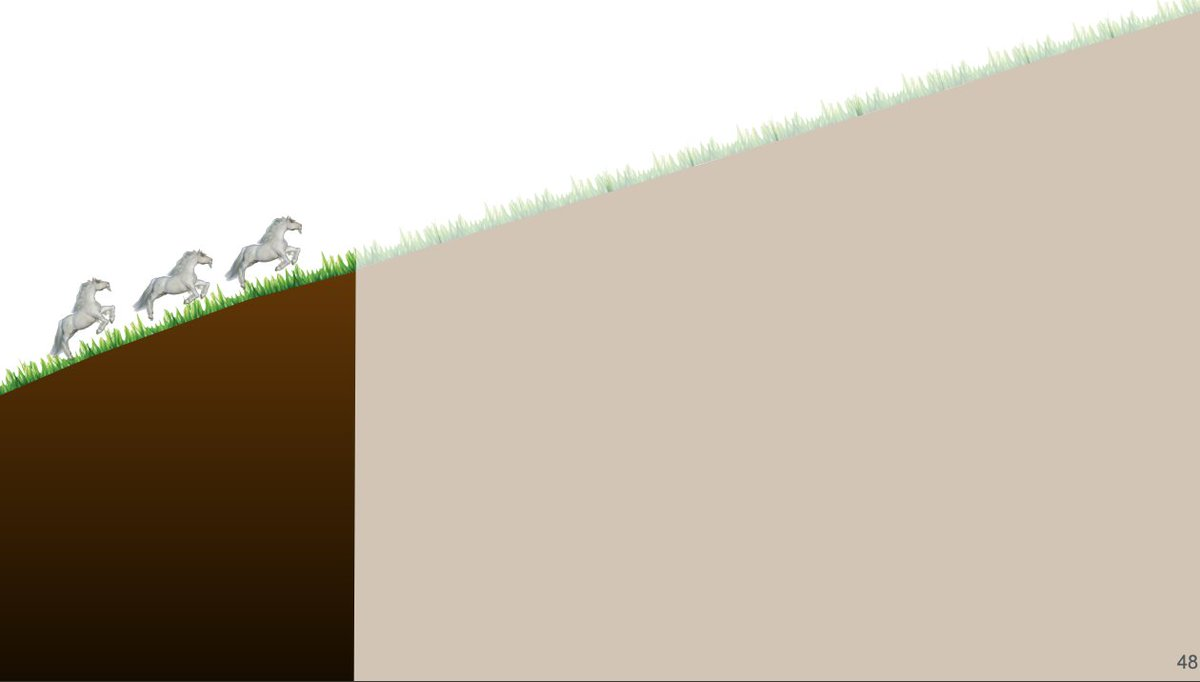

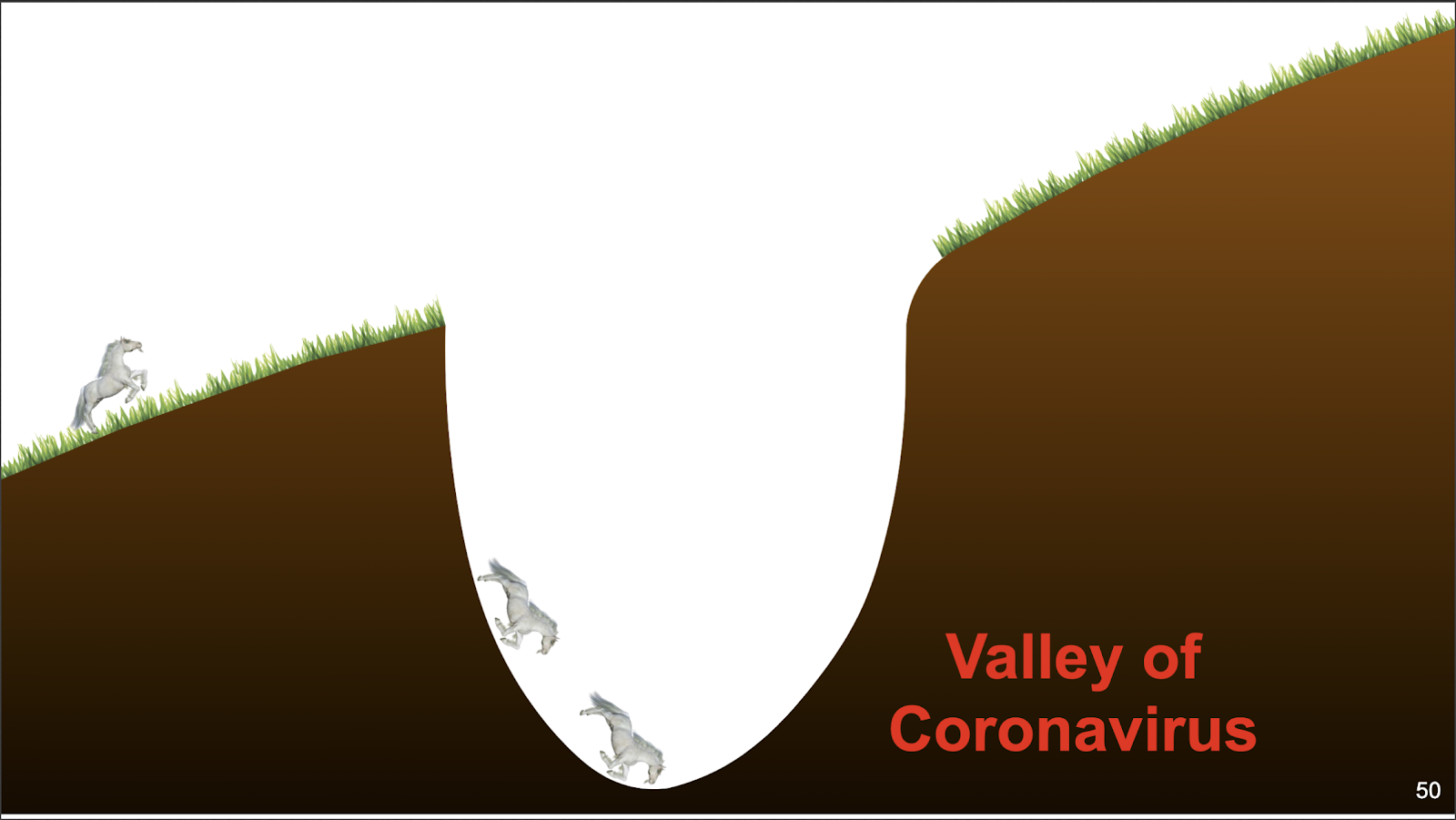

Sure, some unicorns are going to break their necks in the Valley of Coronavirus, SoftBank is probably warning investors here, but some (maybe one) will spread its wings and fly like a Pegasus into the future. And yes, SoftBank may have screwed over some of them. But, in a way, it's a beautiful story about how if you burn billions of dollars on broken startups and foist bags of unicorn feces onto investors, the public, government officials, and the media, there’s a chance that one of those startups will make back the ungodly fortune you wasted.

Sure, some unicorns are going to break their necks in the Valley of Coronavirus, SoftBank is probably warning investors here, but some (maybe one) will spread its wings and fly like a Pegasus into the future. And yes, SoftBank may have screwed over some of them. But, in a way, it's a beautiful story about how if you burn billions of dollars on broken startups and foist bags of unicorn feces onto investors, the public, government officials, and the media, there’s a chance that one of those startups will make back the ungodly fortune you wasted.

Advertisement

Advertisement