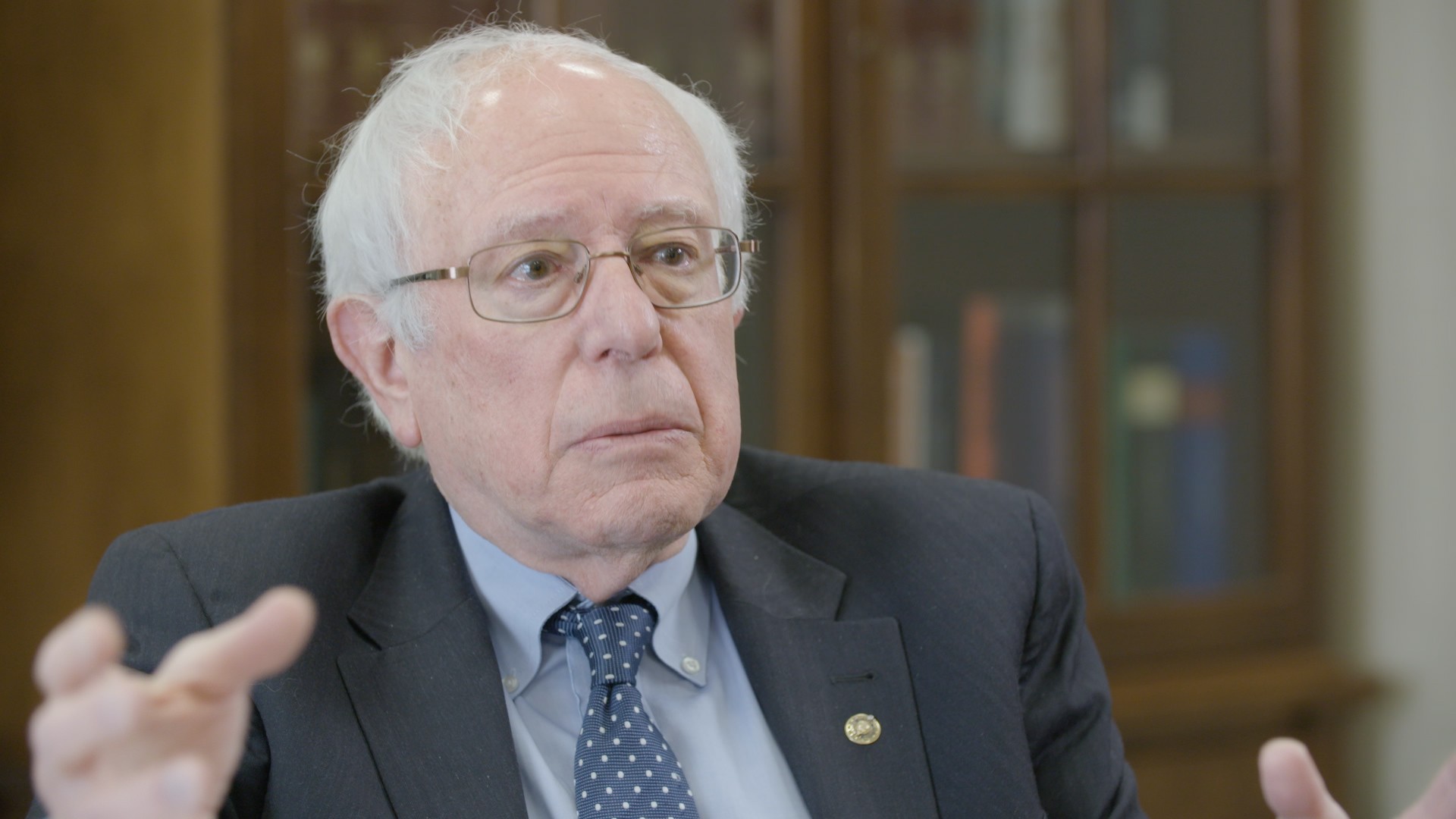

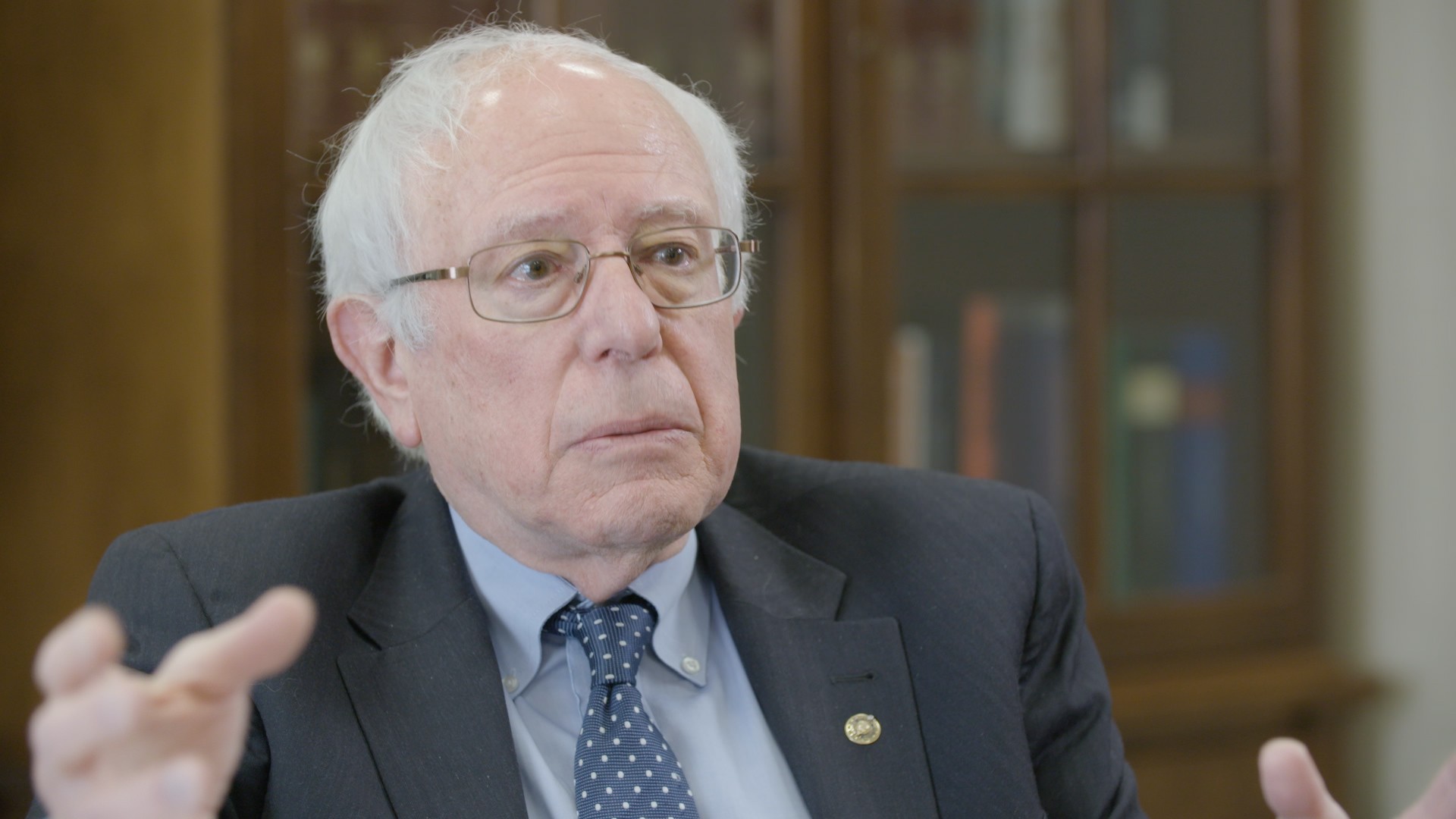

Want the best from VICE News in your inbox? Sign up here.Wall Street’s two worst nightmares are teaming up to take on the credit card and banking industries with a new bill.Progressive darling Rep. Alexandria Ocasio-Cortez and democratic socialist Sen. Bernie Sanders, a 2020 candidate for president, just jointly introduced legislation that caps interest rates on consumer loans at 15%, which would effectively eliminate payday lending. The bill, called the Loan Shark Prevention Act, is Ocasio-Cortez’s first big piece of legislation as a congresswoman. It applies to all consumer loans, including credit cards. Cover: Representative Alexandria Ocasio-Cortez, a Democrat from New York, listens during a House Financial Services Committee hearing in Washington, D.C., U.S., on Wednesday, April 10, 2019. (Photo: Andrew Harrer/Bloomberg via Getty Images)

Cover: Representative Alexandria Ocasio-Cortez, a Democrat from New York, listens during a House Financial Services Committee hearing in Washington, D.C., U.S., on Wednesday, April 10, 2019. (Photo: Andrew Harrer/Bloomberg via Getty Images)

Advertisement

“Today we’re telling Wall Street and the payday lenders that enough is enough,” Sanders said alongside Ocasio-Cortez in an announcement Thursday. “Your grotesque and disgusting behavior is not acceptable in America.”Sanders said they were explicitly hoping to take out payday lenders, which are “disgraceful beyond imagination.” Payday lenders offer loans to poor families that can carry annual interest rates of around 400%.Right now, banks can borrow from the Federal Reserve at a rate just shy of 2.5%. Meanwhile, the average credit-card interest for consumers is at about 17.7%. Americans are expected to pay $122 billion in credit-card interest in 2019 alone.Pretend you’re taking out a credit card at a department store. Let’s say, Macy’s. Stores like these usually charge an interest rate of at least 25%. Credit cards now represent more than 40% of Macy’s profits.“These private equity groups are taking over these everyday retail companies,” Ocasio-Cortez said. “And they stop being companies that are retail and start being essentially finance companies.”Sanders and the freshman New York congresswoman noted that the government has already capped interest rates at credit unions — which are democratically controlled cooperatives — at 15%. Under the bill, states could set interest rates even lower. The bill would also repeal a 1978 Supreme Court decision that allowed national banks to charge whatever interest rates they please by bypassing state caps on interest rates.Although it’s not part of the legislation, Sanders and Ocasio-Cortez are also calling for banking services to be introduced at U.S. postal offices. Sanders called it “universal banking,” and it would provide basic checking and savings accounts, low-interest loans, debit cards, ATMs, money-wiring, and more. Postal banking with low-interest loans would make payday lenders obsolete. Sanders highlighted his 2013 Postal Service Protection Act, which calls for a commission to study the implementation of postal banking.