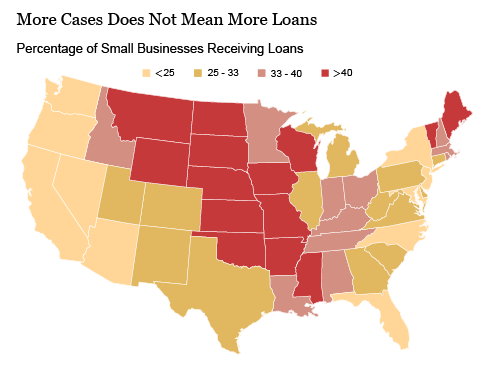

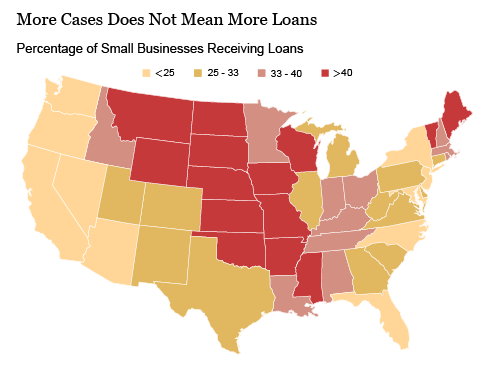

States that are being crushed by the coronavirus aren’t reaping the benefits of the Paycheck Protection Program loans funded by Congress, an analysis of the loans by the Federal Reserve Bank of New York found.In New York, New Jersey, and Washington — three of the hardest-hit states, with more than 1,400 cases per million people as of April 14 — fewer than a quarter of the small businesses that applied for loans got approved, according to Small Business Administration (SBA) data through April 16, when the first round of loans hit its limit.New York, in particular, saw less than 20% approval rates, according to the Fed — even though it’s the global epicenter of the crisis. On the other hand, some states with relatively few COVID-19 cases saw their small businesses get more loans. More than 55 percent of Nebraska businesses that applied for the loans received them, even though the state had seen fewer than a thousand confirmed cases at the time. (Currently, Nebraska has more than 6,300 positive cases and has seen 78 deaths, according to STAT News’ COVID-19 Tracker.)The New York Fed’s analysis found that not only was there no statistically significant relationship between loan allocation and unemployment claims per capita, there was actually a negative relationship between loan allocation and COVID-19 cases, "suggesting that credit is misallocated.”After the original $349 billion ran out — and amid a public outcry over large companies such as the Shake Shack fast-food chain and the Los Angeles Lakers receiving millions meant for smaller firms — Congress put another $310 billion into the fund in April.The new report pours cold water on the emerging GOP line that giving more money to hard-hit states is tantamount to a “blue state bailout,” as Senate Majority Leader Mitch McConnnell said of calls to give federal money directly to states in order to help them through revenue shortfalls and avoid bankruptcy.“There's not going to be any desire on the Republican side to bail out state pensions by borrowing money from future generations," McConnell said in April.On Tuesday, President Donald Trump reiterated the sentiment on Twitter. "Well run states should not be bailing out poorly run States, using CoronaVirus as an excuse!" Trump said.

On the other hand, some states with relatively few COVID-19 cases saw their small businesses get more loans. More than 55 percent of Nebraska businesses that applied for the loans received them, even though the state had seen fewer than a thousand confirmed cases at the time. (Currently, Nebraska has more than 6,300 positive cases and has seen 78 deaths, according to STAT News’ COVID-19 Tracker.)The New York Fed’s analysis found that not only was there no statistically significant relationship between loan allocation and unemployment claims per capita, there was actually a negative relationship between loan allocation and COVID-19 cases, "suggesting that credit is misallocated.”After the original $349 billion ran out — and amid a public outcry over large companies such as the Shake Shack fast-food chain and the Los Angeles Lakers receiving millions meant for smaller firms — Congress put another $310 billion into the fund in April.The new report pours cold water on the emerging GOP line that giving more money to hard-hit states is tantamount to a “blue state bailout,” as Senate Majority Leader Mitch McConnnell said of calls to give federal money directly to states in order to help them through revenue shortfalls and avoid bankruptcy.“There's not going to be any desire on the Republican side to bail out state pensions by borrowing money from future generations," McConnell said in April.On Tuesday, President Donald Trump reiterated the sentiment on Twitter. "Well run states should not be bailing out poorly run States, using CoronaVirus as an excuse!" Trump said.

Advertisement

Advertisement

Not all Republicans agree with Trump and McConnell, though. Maryland Gov. Larry Hogan, whose state’s small businesses received fewer than 25% of the loans they applied for, according to the New York Fed report, called the “blue state bailout” line “complete nonsense” in an interview with Politico last month.“These are well-run states. There are just as many Republicans as Democrats that strongly support this,” Hogan said. “I’m hopeful that we’re going to be able to — between the administration and the 55 governors in America, including the territories — we’re going to convince Sen. McConnell that maybe he shouldn’t let all the states go bankrupt.”

Cover: A business proprietor stands in front of his store on April 30, 2020 in the Lower East Side neighborhood in New York City. (Photo by Stephanie Keith/Getty Images)