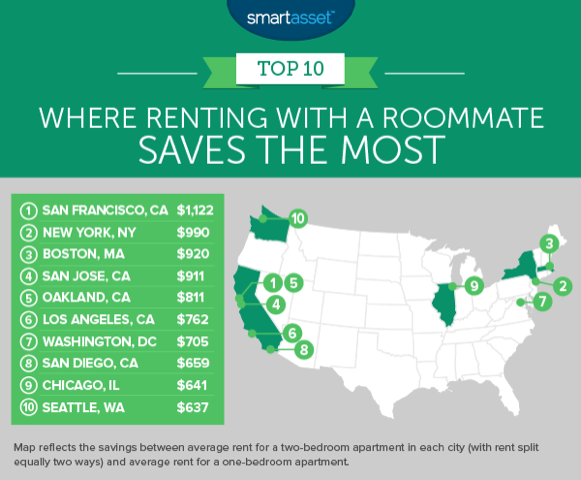

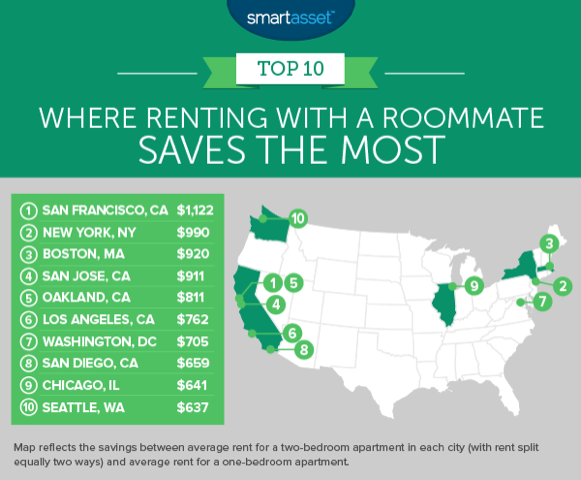

Welcome to the VICE Guide to Life, our imperfect advice on becoming an adult.When Tiffany Aliche was struggling to get out from under $35,000 in debt after the financial crisis, she swallowed her pride and moved into a house she shared with five other roommates in Newark, New Jersey, where she paid just $500 a month in rent.“We didn’t have internet, but because the house was next to the library, we all got library cards and just used the library’s internet,” Aliche says. “The experience was actually one of the most amazing times in my life. I lived with five women and all our friends in the area seemed to just gravitate to our house.”Aliche used the money she saved on rent to wipe out her debt and start a career as a personal finance coach. Several years later, she and her husband now own two homes—one she paid for in cash through an auction site and another she is remodeling to use as income property.So how much should you pay in rent? The standard rule of thumb is to spend no more than 30 percent of your monthly gross income toward rent and utilities. But even that can seem impossible in an an expensive city like San Francisco where a one-bedroom costs around $3,400 a month or even in a less expensive place like Minneapolis where you’ll pay closer to $1,400 a month. So chances are you’ll need to look for ways to save.In case you’re wondering where the 30 percent figure comes from, it’s based on the idea that you’ll need the rest of your money for food, clothes, savings, and of course all the fun stuff like travel and going out for drinks. It’s also the same formula landlords use when deciding if your income is high enough to rent you an apartment. (Taking a broader look at your total budget, consider using the 50/30/20 approach, where half your income goes toward needs including rent, food, and transportation, 30 percent goes toward fun stuff like travel and entertainment, and the rest goes toward savings.)Don’t get too hung up on hitting these numbers exactly—because there's a good chance you can spend even less. In some cases you can spend as little as 20 percent of your income on rent if you’re willing to forgo a lot of privacy and a few creature comforts. “When you move out of your parent’s house that’s when your finances will either dig you into a ditch of brokeness or you will build wealth,” Aliche added. “How much you pay for your apartment is critical.”To decide exactly how much you should budget for rent—plus how to lower costs—use this three-step approach:Before you sign a lease, make sure you know how much money you have to work with in the first place. The typical new college graduate makes about $50,000 a year, which works out to $4,167 a month before taxes. Following the 30 percent rule, that means you should spend no more than $1,250 on rent. But you always want to go under that if possible, so aim for as low as 20 percent or $833 a month.To make sure the number you settle on actually fits with the rest of your spending—meaning it’s enough to cover your student loan payments, guitar lessons, therapy or whatever other costs you have—subtract your estimated rent payments from your total monthly take home pay. If you’re just starting a new job and aren’t sure what that is, here’s a paycheck calculator you can use to estimate. It works out to about $3,100 a month for a $50,000 salary, but your actual take home pay may be less when you factor in state and local taxes, 401(k) contributions, and money you put in a flexible spending account for medical bills and commuter costs.Next, add up all your other costs and subtract those. “Factor in student loans, the electric bill, and other debts,” Aliche said. “Ask the landlord for the average amount for utilities and compare it to your take home pay before you determine how much to pay for rent.” If you can cover all your expenses in without going into negative numbers, then you’ve got a solid budget. If not, you may need to lower your target rent or find other ways to cut back so you don’t get into more debt every time you write a rent check.Need help making the numbers work? The easiest way to hit your target rent is to share your apartment with roommates, which will save you around $800 a month in the ten most expensive cities in the US, according to a 2017 SmartAsset analysis.Turi Reeves, a 26-year old support analyst in Chicago says he pays about $950 a month for a room in a three-bedroom apartment there. “A friend of mine from work knew someone on his kickball team who was looking for a roommate,” he said. “The price was right, it came with a roommate so I wouldn’t have to find one on my own, and the room had more space and a better view than the runner-up space I was looking at.”Here’s how much you can save in rent by getting a roommate in 10 cities according to SmartAsset: If you live in a more affordable city like Tucson, Arizona, take advantage of lower rent prices to start an emergency fund to cover unexpected expense, create a fun fund to pay for your next vacation, or put even more of your earnings toward retirement.If you have your heart set on a pricey city, you can save on rent by finding up-and-coming areas that haven’t reached peak rent yet. In New York consider neighborhoods like Ridgewood, Queens or Jersey City across the Hudson River in New Jersey. In D.C. you can find better deals in areas like Deanwood or Brentwood. And if you want to live in San Francisco, check out the Outer Mission, Outer Richmond or Parkside neighborhoods.You can also get a lower price if you look off-season. “Consider moving in the fall or winter,” Grant Long, Senior Economist at StreetEasy, said. “Once the summer busy season winds down, competition lets up a bit. If you can position yourself on a winter schedule, you’ll have more negotiating power now and in the years to come.”Follow Gina Ragusa on Twitter.

If you live in a more affordable city like Tucson, Arizona, take advantage of lower rent prices to start an emergency fund to cover unexpected expense, create a fun fund to pay for your next vacation, or put even more of your earnings toward retirement.If you have your heart set on a pricey city, you can save on rent by finding up-and-coming areas that haven’t reached peak rent yet. In New York consider neighborhoods like Ridgewood, Queens or Jersey City across the Hudson River in New Jersey. In D.C. you can find better deals in areas like Deanwood or Brentwood. And if you want to live in San Francisco, check out the Outer Mission, Outer Richmond or Parkside neighborhoods.You can also get a lower price if you look off-season. “Consider moving in the fall or winter,” Grant Long, Senior Economist at StreetEasy, said. “Once the summer busy season winds down, competition lets up a bit. If you can position yourself on a winter schedule, you’ll have more negotiating power now and in the years to come.”Follow Gina Ragusa on Twitter.

Advertisement

Advertisement

Step 1: Figure out your total budget

Advertisement

Step 2: Get a roommate to save big