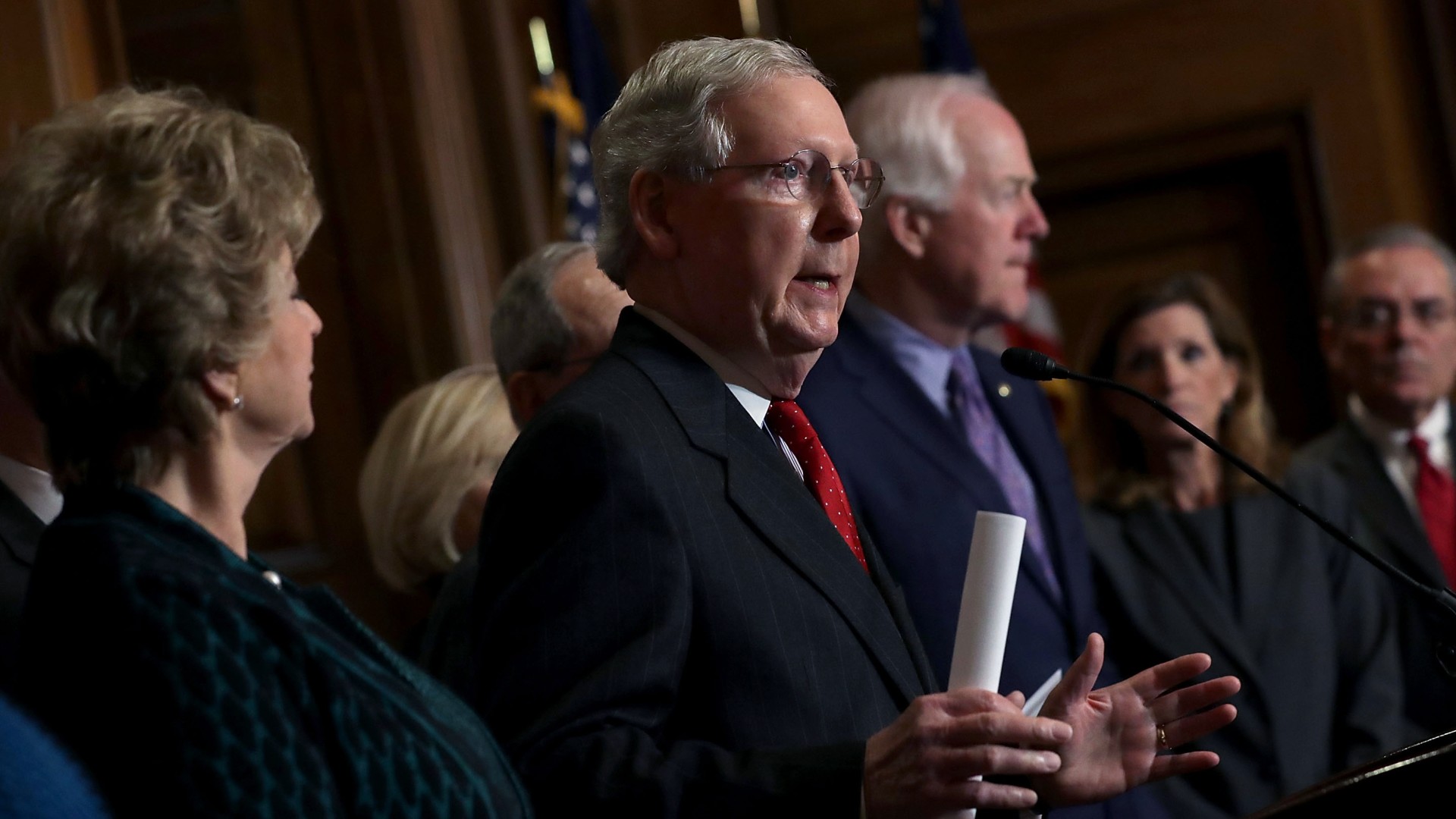

And, while only 4,700 of America’s wealthiest families paid the estate tax last year, the exemption will be raised from current levels of $5 million to $10 million per person in the Senate bill – and it will be repealed completely in the House version. A total repeal will reportedly save President Trump’s family more than $1 billion. One Ted Cruz Michigan Republican, reflecting on the benefits that will flow to wealthy families, told The Washington Post: “The level of lifestyle that they have versus everyone else — why do they need [a tax cut]?”Americans earning between $50,000 to $75,000 a year will likely see their tax burden increase in 2019 under the Republican plan. Added to this, many popular middle class deductions for student loans, mortgages, local taxes, unpaid employee expenses, and high medical costs would be repealed.The bill has been skewered by most of Washington’s independent tax analysts and Republicans even scrambled to discredit the non-partisan cost experts at the Joint Committee on Taxation when it produced its official estimate that the tax bill would add $1 trillion or more to the deficit.When it came to passing the new hastily prepared tax legislation, Senate leader Mitch McConnell abandoned his self-proclaimed reverence for careful deliberation. After repeated defeats on the repeal of the Affordable Care Act, he and his fellow Republicans were hungry for a win that could also assuage big political campaign donors.Americans earning between $50,000 to $75,000 a year— will likely see their tax burden increase in 2019 under the Republican plan.

Check out more videos from VICE:

McConnell’s top campaign contributor is The Blackstone Group, a private equity firm that has invested nearly $300,000 into the majority leader’s campaigns. Blackstone was recently singled out in the Paradise Papers for aggressively working to shelter its profits from taxation by routing money to Luxembourg and the small island of Jersey, off the coast of Normandy, France.

While Blackstone and other corporate heavyweights have, for years, reduced their tax bills through fancy footwork, they apparently still believe they are forking over too much money to the feds. In truth, corporate taxes contribute substantially less to the U.S. Treasury than they used to. Sixty years ago, America’s largest companies contributed one-third of all federal tax revenue. Today, just one-tenth of federal revenues come from corporations, according to Americans For Tax Fairness.There weren’t as many lobbyists 60 years ago, either, or as much money being lavished on politicians. In 1986, the Senate took its time and passed the largely bipartisan Reagan tax bill. Instead of scribbling last-minute language in the margins, Congress took two years to consider, draft, and debate that tax plan. The final law still had problems, but most families saw a tax break while the rates on corporations rose.This time around, corporations were largely given carte blanche over the process. Blackstone, which was a relatively small player in this fight, still hired six lobbyists to wage war in the Capitol. This came on top of the millions of campaign dollars the company has directed to powerful members of congress, from House Speaker Paul Ryan to Orrin Hatch, a Utah Republican who chairs the Senate Finance Committee.Corporations were largely given carte blanche over the process.

As it stands now, the Senate and House tax proposals would reward companies that have essentially undermined the Internal Revenue Service by holding funds in foreign accounts. Republicans are now offering half a trillion dollars in tax breaks to these offshoring companies that are willing to bring their profits home. This repatriation provision came following intense lobbying pressure from some of the leading tax avoiders, including Blackstone, Google, and General Electric.According to an analysis by Public Citizen, more than half of all registered lobbyists in Washington worked in some capacity on tax reform this year. This sea of 6,243 lobbyists equates to roughly 11 lobbyists for each member of congress.Microsoft deployed 81 lobbyists and General Electric mobilized a platoon of 65 schmoozers. The U.S. Chamber of Commerce, a conservative business-oriented lobbying group, deployed the largest contingent, with 100 lobbyists. Even longtime deficit hawks like the Koch brothers cravenly abandoned their principles for the purpose of self-enrichment through the lopsided Republican tax cuts.A strange menagerie of legislative add-ons made their way through the legislative thicket, to compensate for earlier laws that Republicans wished to nullify. Alaska Senator Lisa Murkowski managed to attach a provision to open up oil drilling in the environmentally fragile Alaska Wildlife Reserve and opponents to the Affordable Care Act, unable to win earlier votes to repeal former President Obama’s signature legislation, managed to cancel the tax penalty assessed on people who do not carry health coverage. Analysts believe that this change will drive health care costs higher by reducing the pool of insured people and many of these same observers feel that the tax bill will trigger cuts to Medicare that are mandated by Congress when deficits increase.More than half of all registered lobbyists in Washington worked in some capacity on tax reform this year. This sea of 6,243 lobbyists equates to roughly 11 lobbyists for each member of congress.

An amendment from Sen. Pat Toomey, R-Pa. proposed to shield Hillsdale College from new taxes other colleges will face. This provision was removed after Democrats discovered some of the college’s notable alumni, including Republican super donor and Education Secretary Betsy Devos, as well as her brother and Blackwater founder Erik Prince. The chief of the conservative Club For Growth is also a former “Hillsdale Charger” and close friends with Toomey.Nobody likes to spend much time or energy preparing their taxes and it seems that Republicans are betting the same holds true when it comes to protesting the massive tax cuts that largely favor America’s wealthiest families and corporations. Still, the House and Senate bills need to be reconciled in a conference committee that could make additional changes or roll back especially unpopular provisions.While Senate leaders have yet to appoint their conference committee representatives, names have been picked in the House. If one of these members of congress represents your state, call them up and let them know your thoughts.Nobody likes to spend much time or energy preparing their taxes and it seems that Republicans are betting the same holds true when it comes to protesting the massive tax cuts that largely favor America’s wealthiest families and corporations.

Republicans

- Kevin Brady of Texas

- Devin Nunes of California

- Peter Roskam of Illinois

- Diane Black of Tennessee

- Kristi Noem of South Dakota

- Rob Bishop of Utah

- Don Young of Alaska

- Greg Walden of Oregon

Democrats

- Richard Neal of Massachusetts

- Sander Levin of Michigan

- Lloyd Doggett of Texas

- Raúl Grijalva of Arizona

- Kathy Castor of Florida