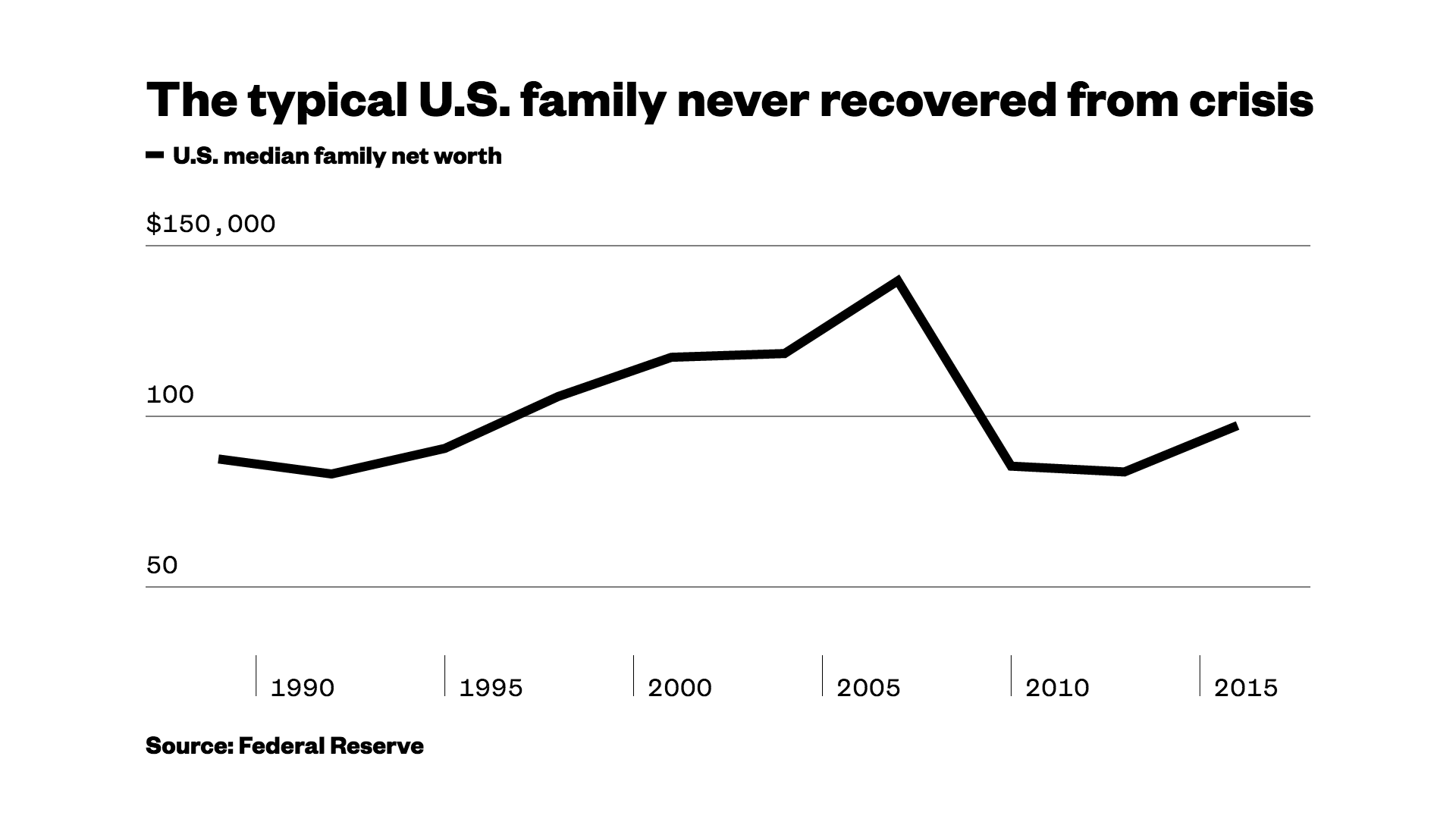

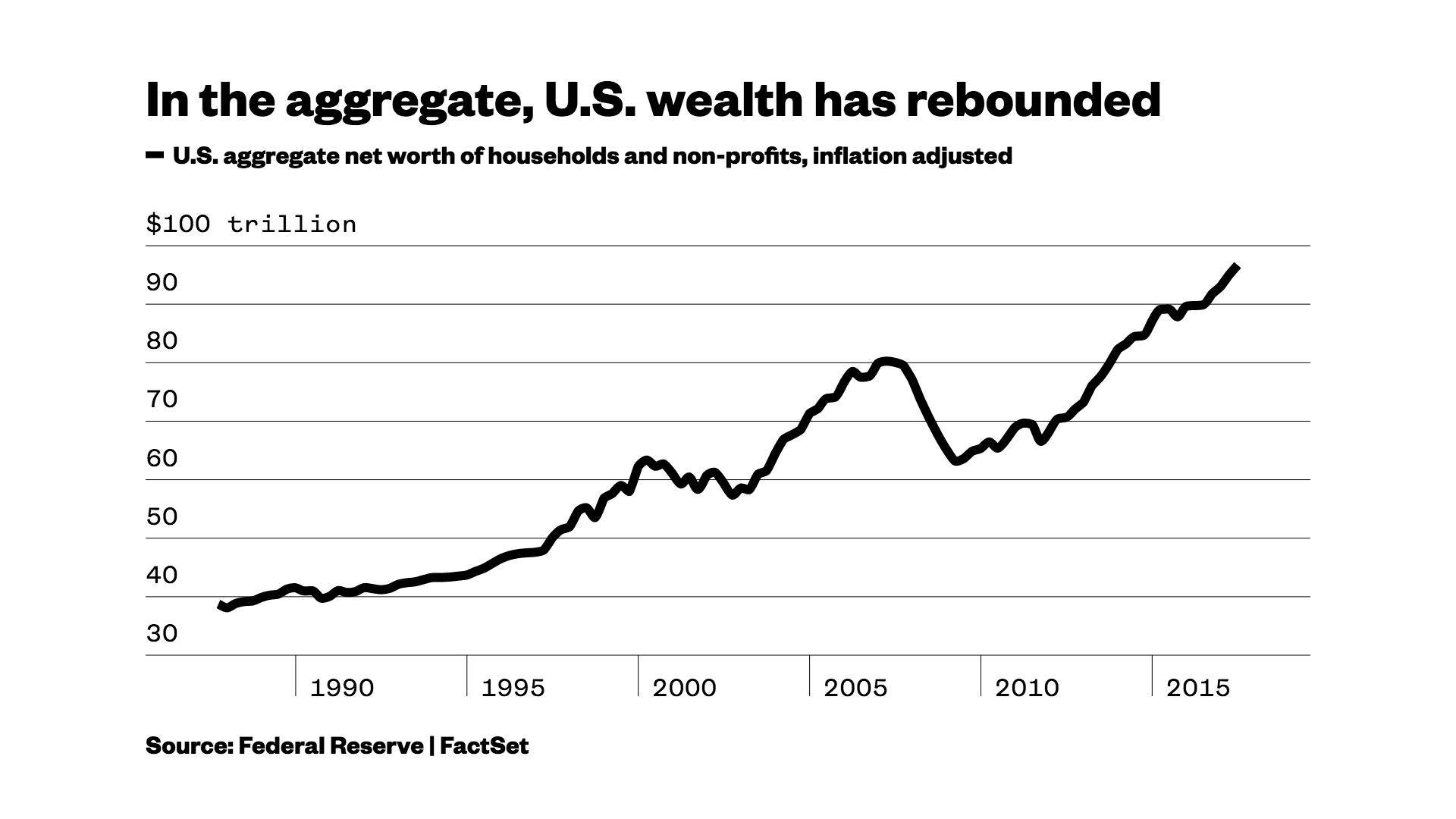

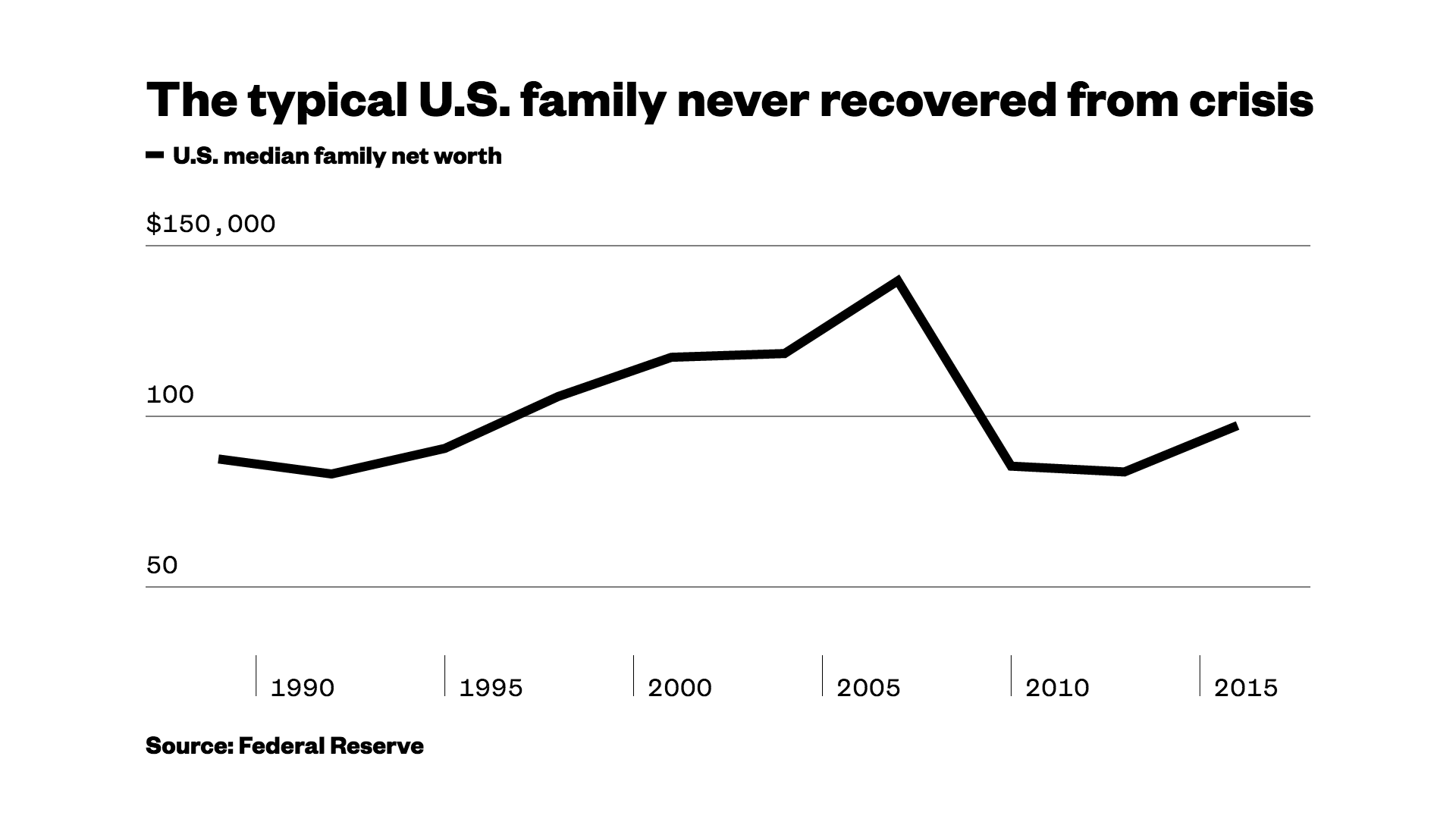

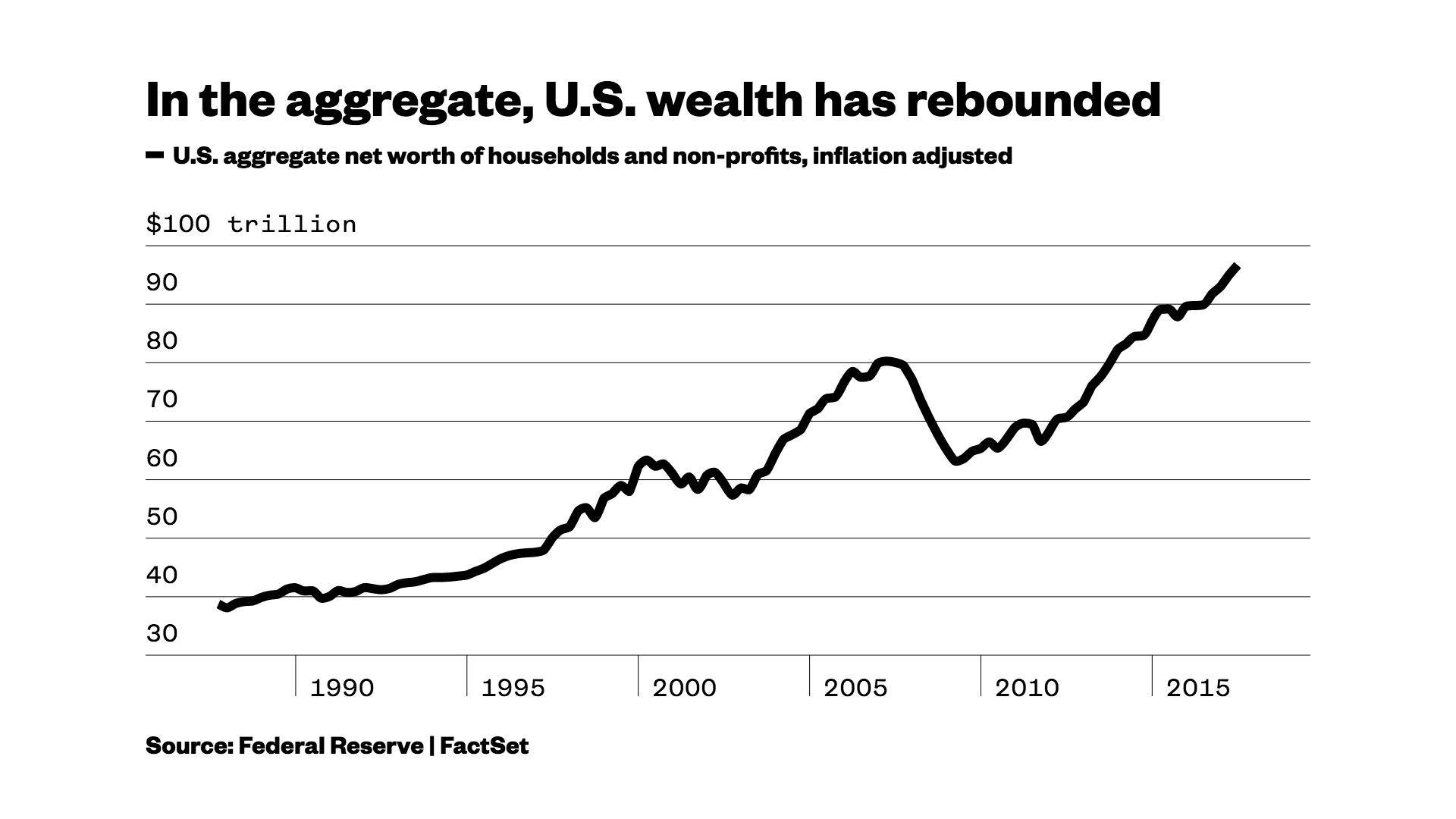

New numbers from the Federal Reserve’s in-depth survey of the financial state of U.S. households released last week helps explain much of the nation’s dour mood and increasingly fractious.The simple fact is the typical American family was far less wealthy in 2016 than before the financial crisis and Great Recession struck a decade ago, according to findings from the Fed’s triennial Survey of Consumer Finances.That’s despite the fact that median net worth of a typical family in 2016 was $97,300, up 16 percent from 2013, the last time this particular Fed survey was conducted.Even so the typical family’s wealth was still 30 percent lower than in 2007, when the average family’s net worth of nearly $140,000, a reflection of the lasting damage the housing bust inflicted on American affluence.In fact, net worth for a family in 2016 — assets minus debt —remained 8 percent below its 1998 level of roughly $106,000. In short, American families have suffered roughly two decades of wealth stagnation, despite years of job growth and economic recovery.The numbers released this week were part of the Fed’s intensive triennial Survey of Consumer Finances, in which more than 6,200 families participated in interviews about the state of their finances. The interviews typically last 90 minutes, and in some cases stretched to three hours, the Fed said. That level of detail allows the survey of consumer finances to paint a much more granular — and in some cases less rosy — picture of American household finances than economic snapshots that are based on high-level aggregates data.For example, the Fed’s quarterly data shows that overall net worth of households and nonprofits has more than recovered from the steep decline suffered during the housing and stock market busts of 2008 and 2009. The most recent number for the second quarter of 2017 shows aggregate household net worth at a record $96.2 trillion, driven higher by large rebounds in the housing and stock markets.

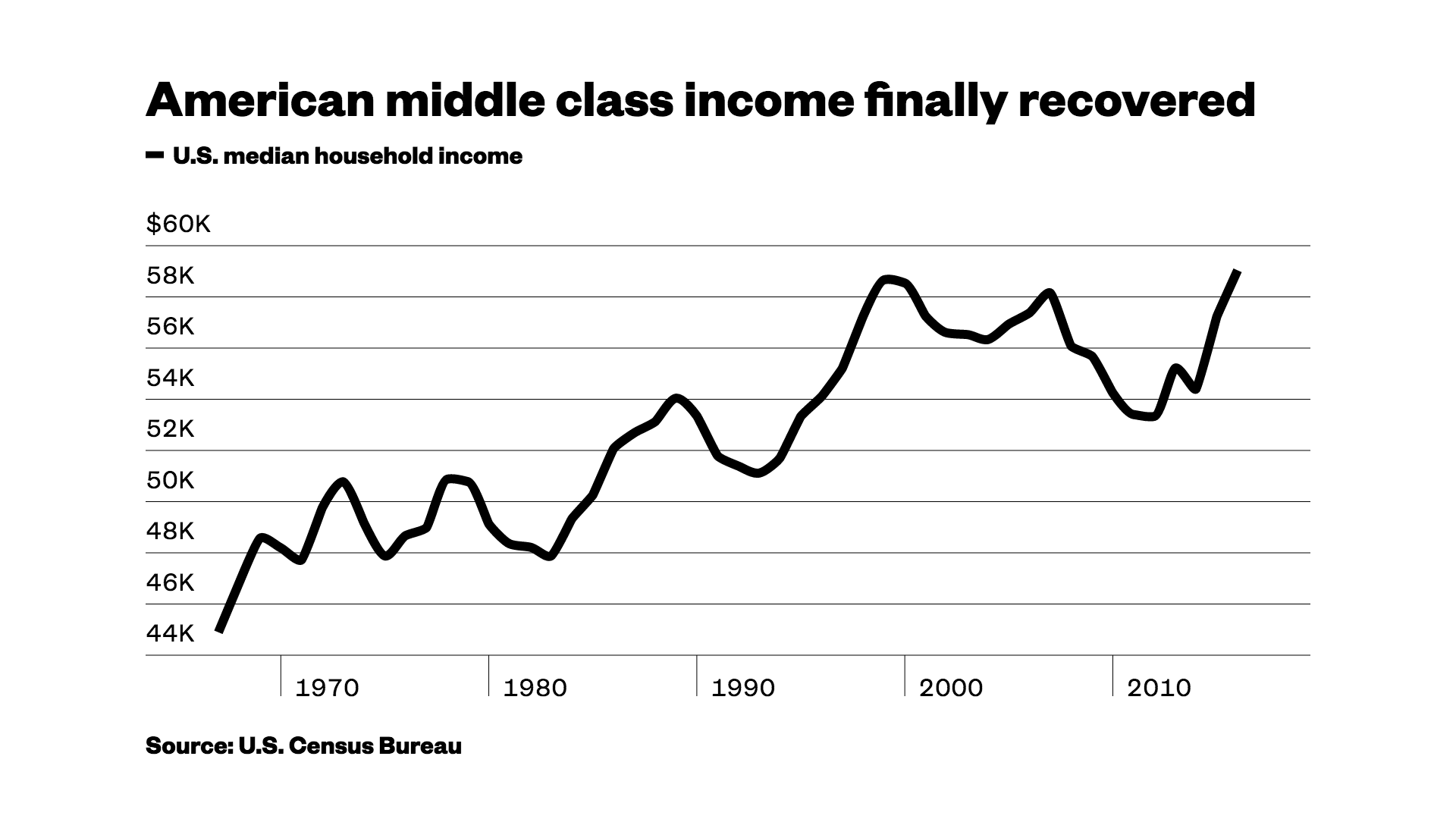

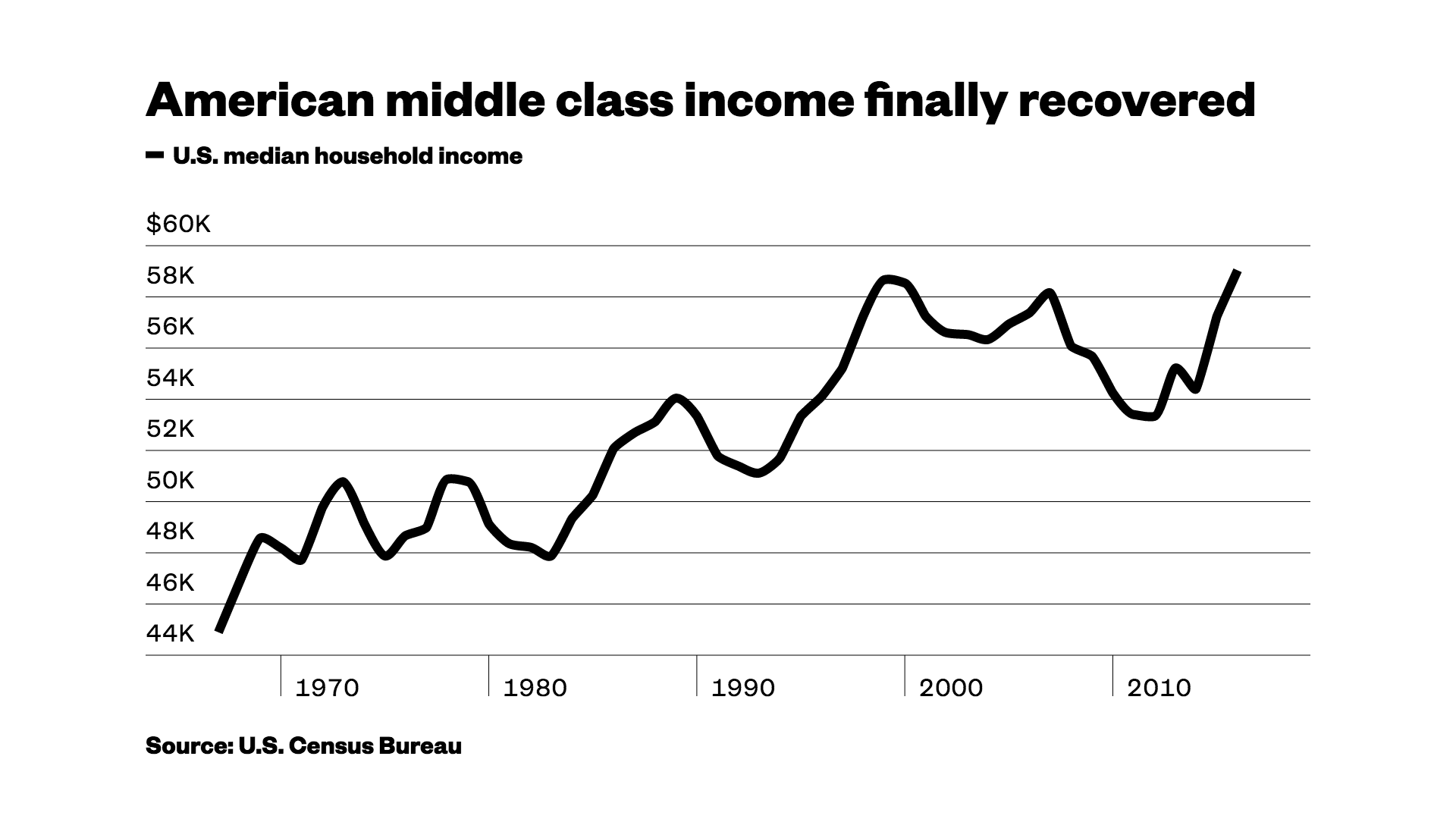

In short, American families have suffered roughly two decades of wealth stagnation, despite years of job growth and economic recovery.The numbers released this week were part of the Fed’s intensive triennial Survey of Consumer Finances, in which more than 6,200 families participated in interviews about the state of their finances. The interviews typically last 90 minutes, and in some cases stretched to three hours, the Fed said. That level of detail allows the survey of consumer finances to paint a much more granular — and in some cases less rosy — picture of American household finances than economic snapshots that are based on high-level aggregates data.For example, the Fed’s quarterly data shows that overall net worth of households and nonprofits has more than recovered from the steep decline suffered during the housing and stock market busts of 2008 and 2009. The most recent number for the second quarter of 2017 shows aggregate household net worth at a record $96.2 trillion, driven higher by large rebounds in the housing and stock markets. Looks pretty good at first glance. But this essentially just tells us how big the overall “pie” of American wealth is. It doesn’t tell you who gets a sliver or who gets a large slab.As the new data released yesterday shows us, those in the top 10 percent of American wealth take the biggest chunk by far. For instance, New York University’s Edward Wolff found — using Fed data for 2010 — that the wealthiest 10 percent of American families own more than 80 percent of the U.S. stock market. So the vast majority of the gains in the stock market over the last few years have gone to relatively few people.Similarly, while housing remains the most important asset for most families, fewer and fewer families actually own houses. Homeownership rates fell to 63.7 percent in 2013, according to the most recent Federal Reserve survey — the lowest level on record going back to 1989. That means fewer American families benefitted financially from the rebound in housing prices over the last few years.The Fed’s numbers also help explain why sharp increases in income in recent years haven’t done much to improve the national mood.Median household income, a key measure of what a typical U.S. household makes, rose 3.2 percent to $59,039 in 2016, according to new data from the U.S. Census Bureau. That’s the first time the annual household income number climbed back to the level it hit back in 2007, when the median income was $58,149. In fact, 2016 incomes are effectively back to where they were at their all-time peak in 1999, when they hit $58,665.

Looks pretty good at first glance. But this essentially just tells us how big the overall “pie” of American wealth is. It doesn’t tell you who gets a sliver or who gets a large slab.As the new data released yesterday shows us, those in the top 10 percent of American wealth take the biggest chunk by far. For instance, New York University’s Edward Wolff found — using Fed data for 2010 — that the wealthiest 10 percent of American families own more than 80 percent of the U.S. stock market. So the vast majority of the gains in the stock market over the last few years have gone to relatively few people.Similarly, while housing remains the most important asset for most families, fewer and fewer families actually own houses. Homeownership rates fell to 63.7 percent in 2013, according to the most recent Federal Reserve survey — the lowest level on record going back to 1989. That means fewer American families benefitted financially from the rebound in housing prices over the last few years.The Fed’s numbers also help explain why sharp increases in income in recent years haven’t done much to improve the national mood.Median household income, a key measure of what a typical U.S. household makes, rose 3.2 percent to $59,039 in 2016, according to new data from the U.S. Census Bureau. That’s the first time the annual household income number climbed back to the level it hit back in 2007, when the median income was $58,149. In fact, 2016 incomes are effectively back to where they were at their all-time peak in 1999, when they hit $58,665. But despite those improvements, the national mood remains decidedly sour.Roughly 67 percent of the American public says it is dissatisfied with the direction the country is going in, according to recent data from Pew Research.And Americans are increasingly gloomy about the outlook for the country, with 48 percent saying that future for the next generation will be worse than today.They weren’t even that gloomy during the worst of the Great Recession and the long slow recovery. And from a longer-term perspective, research has shown that Americans of middle and less than middle income are significantly less happy than they used to be.The stark decrease in wealth—and the security and safety it provides—among large chunk’s of the American population helps explain why.

But despite those improvements, the national mood remains decidedly sour.Roughly 67 percent of the American public says it is dissatisfied with the direction the country is going in, according to recent data from Pew Research.And Americans are increasingly gloomy about the outlook for the country, with 48 percent saying that future for the next generation will be worse than today.They weren’t even that gloomy during the worst of the Great Recession and the long slow recovery. And from a longer-term perspective, research has shown that Americans of middle and less than middle income are significantly less happy than they used to be.The stark decrease in wealth—and the security and safety it provides—among large chunk’s of the American population helps explain why.

Advertisement

Advertisement

Advertisement