Advertisement

The first part of the experiment was to create the so-called ticker tracks. I gleaned information from various futures and foreign-exchange markets to generate sounds that would correspond to real-time price data. According to research, rats respond especially well to the piano, so I chose this instrument for the audio clips. I composed them with Sonification Sandbox, a program provided by the School of Psychology at the Georgia Institute of Technology (the software is an ideal environment for transforming data into sound, a process known as sonification).The sound changed in connection with the price movement: When the price went up, the pitch rose; when the price went down, the pitch fell. Depending on how long it took for the next trade to happen (time between trades varies between a second and a minute), I used different kinds of piano modulations.

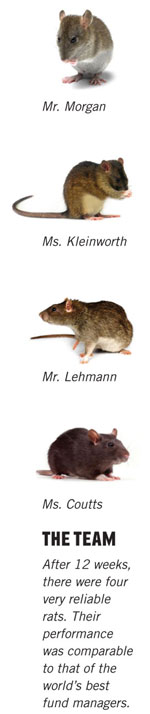

I started with 80 Sprague-Dawley lab rats, 40 males and 40 females, intending to breed the best of them to create the most genetically fit traders. In Skinner boxes, widely used in animal experiments, the rats trained separately for five hours daily (thanks to Anna, Gerda, and Dirk, who did great work with them). All told, the process took about three months.To train the rodents, I produced ticker tracks for about 800 different market situations (I restricted these to USD/EUR futures, though rats may become experts in any segment of the market). We played 100 of these tracks for the rats every day, in hopes that they'd eventually seek out sound patterns unrecognizable to humans and predict the next market move after the last sound they heard.

Advertisement

After extensive training we wanted to learn whether the talent was genetically rooted, so we bred the top traders with each other. After only 20 days, we had 28 new rats (15 males and 13 females), and we soon started to train again (even reducing the training time). The results were astounding: The second generation of top traders had a much better performance than their parents, but further research will be necessary to confirm this finding of ours.I am now working on software that generates real-time ticker tracks so I can put the system to the ultimate test (market conditions in the real world). If the performance is good, I will keep the experiment going and either set up my own hedge fund managed by my rats or train them to work for banks.This study originally appeared in Art and Economy, a journal published by the Landia Art and Economy Foundation, and is reprinted here with permission.