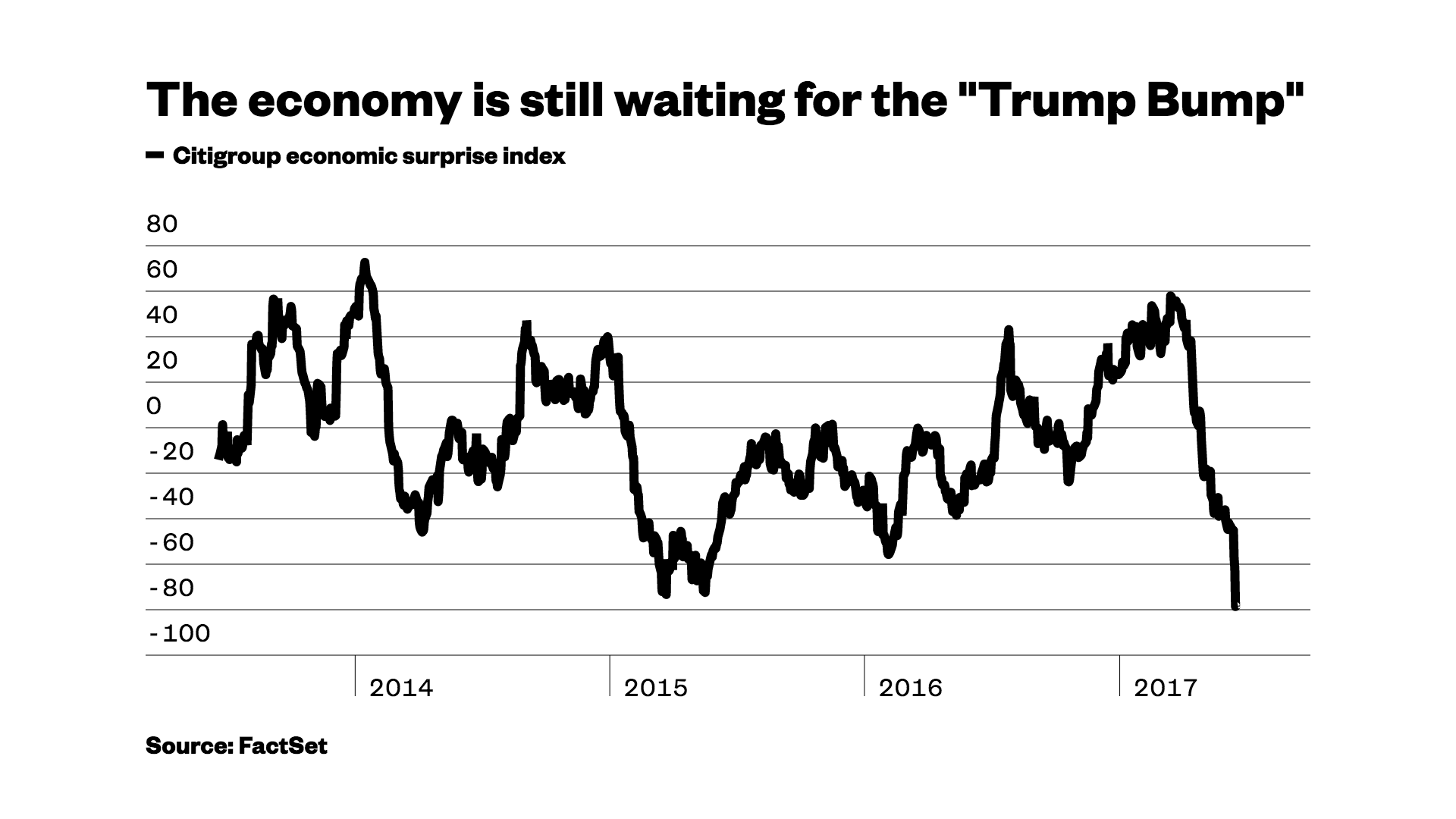

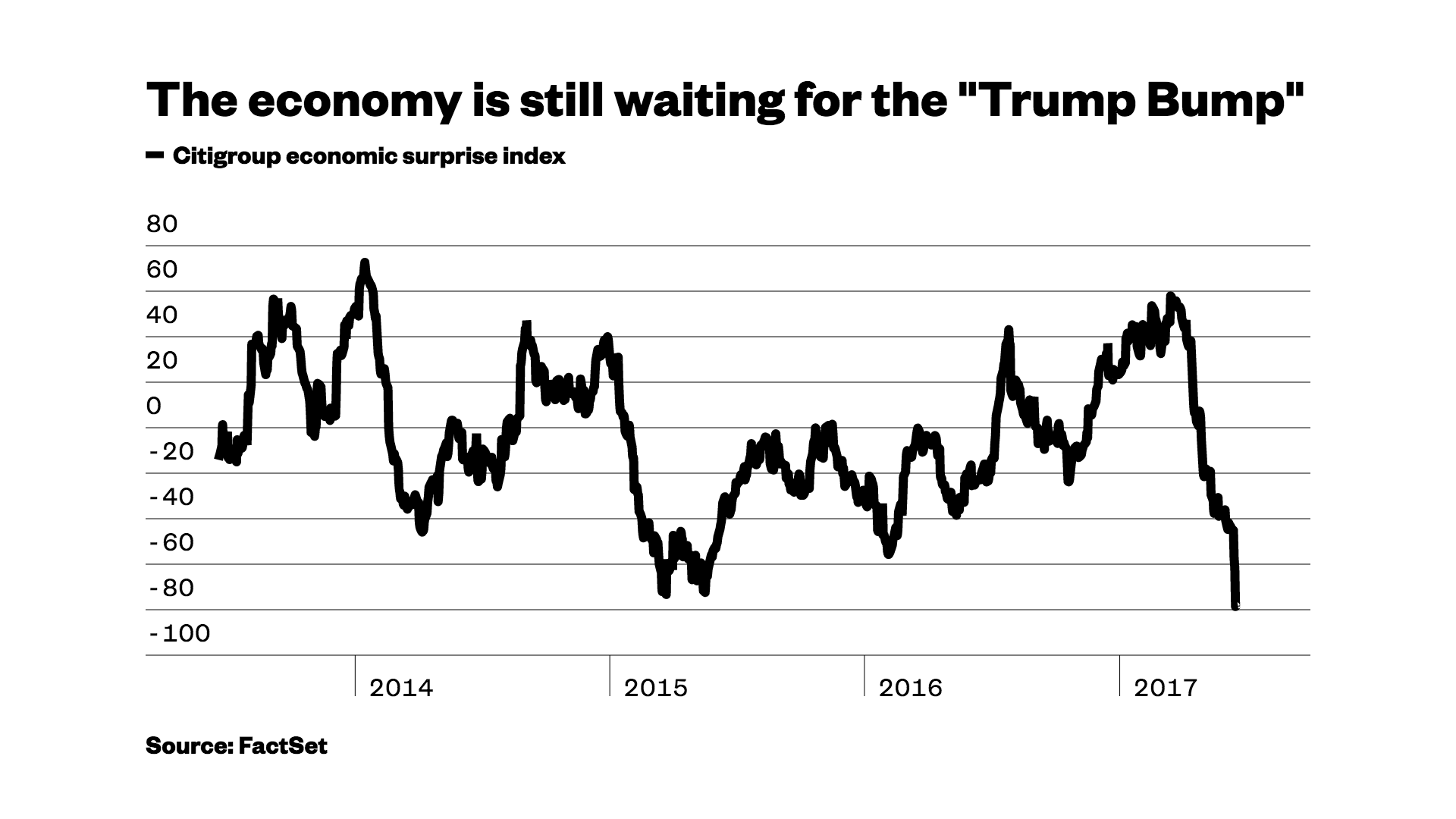

The U.S. stock market surged after Donald Trump’s victory in the presidential election last November. Thing is, nobody really knows why.Brokers, economists, analysts, strategists, and other hacks of various stripes all get paid to have an explanation for it, so they came up with this: The stock-market surge was simply an anticipation of the economic boom that would follow once a real estate showman-cum-reality-television star made his way to the Oval Office.Yes, Trump and the Republican-controlled Congress were expected to push through a raft of programs boosting growth — including infrastructure and defense spending, corporate and personal tax cuts, regulations making bank lending easier by eliminating pesky rules that keep them from collapsing, and the undoing of decades of environmental protections.And yet, six months into the Trump administration, there’s very little indication that the economy has experienced, or is about to experience, a “Trump bump.” During the first quarter of this year, the economy expanded at a sluggish 1.2 percent pace. Although the unemployment rate remains low, job creation has been disappointing in recent months. While strong price pressure is usually interpreted as a sign of a growing economy, inflation has been tepid. New home construction has been slow. Retail and auto sales have been weak — or at least, weaker than expected.Long story short: The economy has consistently underdelivered on the high hopes. That’s apparent in Citigroup’s so-called Economic Surprise Index, which measures whether economic data is better or worse than forecasted. The index has fallen off a cliff in recent weeks. This doesn’t mean we’re about to enter a recession. But the economy isn’t quite living up to the inflated expectations that have guided sentiment and stock indexes higher since Trump took office.And with the administration mired in scandal and investigations, and eight senators in a bunker somewhere crafting a top-secret bill that will undo the Affordable Care Act — creating considerable uncertainty for roughly one-sixth of the U.S. economy — it seems that CEOs are getting concerned the policies promised to boost the economy might never come to be.Not that those CEOs are saying that out loud. In fact, a recent report from Washington trade group the Business Roundtable suggested that CEO outlooks for the economy reached their highest level in three years.Corporate leaders are not known for their candor; instead, they need to project confidence and optimism. They also need to avoid making waves when a thin-skinned Tweeter-in-chief can lop billions of dollars in market value off their companies with a few threats. But while what CEOs say may not tell you much, what they do is a different story.And what they do when they’re feeling good is make big, bold, expensive, and often dumb deals. Which have been few and far between. The New York Times’ Andrew Ross Sorkin recently showed how there’s been a dearth of deals lately, notwithstanding the roughly $14 billion Amazon bid for Whole Foods last week. That suggests U.S. business leaders are far more cautious about the future than they say.And other indicators, such as sharply slowing business-loan demand, suggest that business investment is in wait-and-see mode. Year-over-year bank lending was up just 1.9 percent in early June. That’s near the lowest levels since bank lending first turned positive in the aftermath of the banking bust and financial crisis.

This doesn’t mean we’re about to enter a recession. But the economy isn’t quite living up to the inflated expectations that have guided sentiment and stock indexes higher since Trump took office.And with the administration mired in scandal and investigations, and eight senators in a bunker somewhere crafting a top-secret bill that will undo the Affordable Care Act — creating considerable uncertainty for roughly one-sixth of the U.S. economy — it seems that CEOs are getting concerned the policies promised to boost the economy might never come to be.Not that those CEOs are saying that out loud. In fact, a recent report from Washington trade group the Business Roundtable suggested that CEO outlooks for the economy reached their highest level in three years.Corporate leaders are not known for their candor; instead, they need to project confidence and optimism. They also need to avoid making waves when a thin-skinned Tweeter-in-chief can lop billions of dollars in market value off their companies with a few threats. But while what CEOs say may not tell you much, what they do is a different story.And what they do when they’re feeling good is make big, bold, expensive, and often dumb deals. Which have been few and far between. The New York Times’ Andrew Ross Sorkin recently showed how there’s been a dearth of deals lately, notwithstanding the roughly $14 billion Amazon bid for Whole Foods last week. That suggests U.S. business leaders are far more cautious about the future than they say.And other indicators, such as sharply slowing business-loan demand, suggest that business investment is in wait-and-see mode. Year-over-year bank lending was up just 1.9 percent in early June. That’s near the lowest levels since bank lending first turned positive in the aftermath of the banking bust and financial crisis. And if you really want to get wonky, you could look at falling yields on super-safe U.S. government bonds. All else equal, long-term bond yields tend to rise with expectations of higher economic growth. That ain’t happening.Again, this doesn’t mean we’re about to have another recession, though it could increase the risk. But it does raise some interesting questions.How long can the stock market keep running on the fumes of optimism if economic growth doesn’t start to pick up steam? Why aren’t companies borrowing big to take advantage of the next phase of the expansion? Why is job growth slower than expected? What can be done to keep the third-longest streak of U.S. economic growth on record going? And perhaps most importantly: Can the Trump administration be trusted to keep it going?Nobody really knows.

And if you really want to get wonky, you could look at falling yields on super-safe U.S. government bonds. All else equal, long-term bond yields tend to rise with expectations of higher economic growth. That ain’t happening.Again, this doesn’t mean we’re about to have another recession, though it could increase the risk. But it does raise some interesting questions.How long can the stock market keep running on the fumes of optimism if economic growth doesn’t start to pick up steam? Why aren’t companies borrowing big to take advantage of the next phase of the expansion? Why is job growth slower than expected? What can be done to keep the third-longest streak of U.S. economic growth on record going? And perhaps most importantly: Can the Trump administration be trusted to keep it going?Nobody really knows.

Advertisement

Advertisement