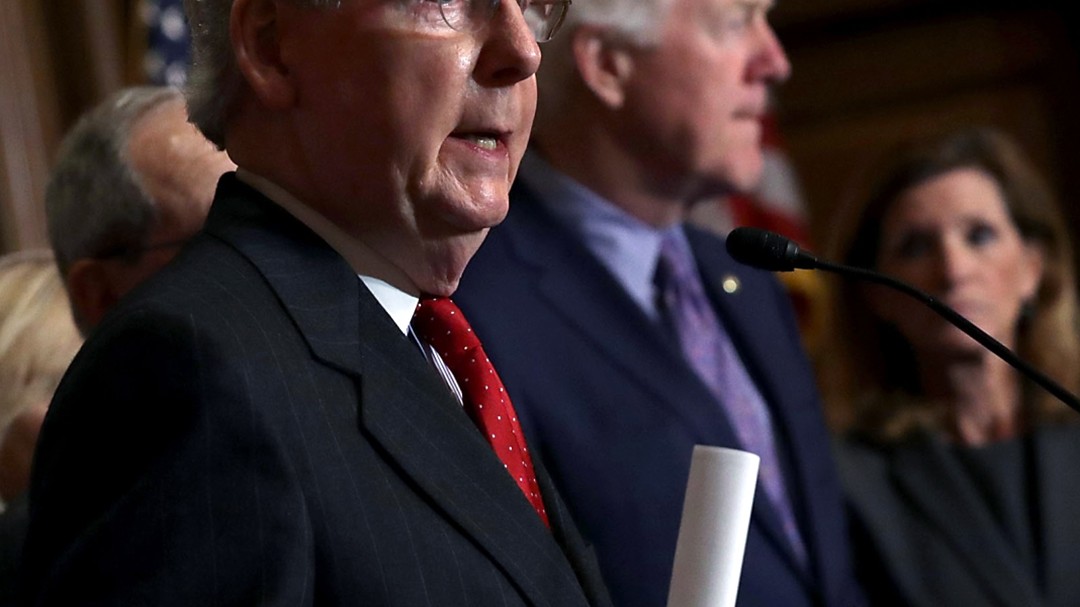

Image via Flickr

After months of failed attempts to pass new tax law in which a Republican-majority House couldn’t even get all of the Republicans on board, Congress was finally able to pass the bill in December. But the 500-plus-page Tax Cuts and Jobs Act wasn’t just about taxes -- it also had a number of unrelated items attached that passed too. Up close, the changes in the tax plan seem to look fairly positive, but stepping back, it’s clear there is some negative impact ahead, especially for young people (like preserving graduate student tax breaks), especially once the temporary provisions and tax cuts wear off.Millennials already struggle to keep health insurance, even with Obamacare, which allows people to be on their parent’s coverage until the age of 26. Yet 16 percent of Americans between the ages of 25 to 34 do not have health insurance. The tax bill’s repealing of the Obamacare mandate, which Republicans wanted to nix because it penalizes people for not getting insured, is estimated to actually lower the number of insured Americans by another 13 million people. This will likely raise health insurance premiums going forward, making it even more of a strain on young people struggling to afford coverage.“Anyone who voted for it is going to have a tough time looking a hardworking young person in the face and argue that this was a good bill for their future,” Association of Young Americans (AYA) Founder, Ben Brown, 28, told VICE Impact. The AYA is a non-partisan organization designed to have a voice for young people, especially those who struggle, and ultimately to lobby on behalf of the issues they care about.“Tax reform was a huge opportunity to simplify a complicated and expensive system to help normal families struggling with bills,” said Brown. “Yet, unfortunately, the majority of the benefits of the bill overwhelmingly go to companies and the wealthy.”According to Brown, young people between the ages of 18 and 36 average about six relocations, moving apartment to apartment which is more than they are likely to have the rest of their lives. Now, thanks to the new tax law, people with work relocation expenses have lost the benefit of filing those deductions at tax time. And, speaking of tax time, the deductions for tax preparation have gone away as well.

Check out more videos from VICE:

In addition, deductions for bike commuters have been removed in the new bill, set to take place in 2018. Although not stated in the tax bill, Trump also announced a 30-percent solar panel import tariff at the start of 2018, as well, so young people can look forward to backpedaling environmentally both now and in the future as they continue to deal with possible increases in pollution and climate change as a result.“The tax code needs to be updated to reflect 21st Century America, and should recognize new social norms. The repeal of the tax free bike commuter benefit is a failure to recognize and embrace the decline in car ownership and alternative commuter preferences,” Brown said.In order to be heard, Brown says that America’s youth has to continue to do what we’ve been doing: working hard and speaking out.“Young people are essential to this country’s growth and future success, yet face enormous political and social inequality. Quite frankly, it’s shameful and embarrassing to see how the values and needs of young Americans aren’t being taken seriously by our government,” Brown said. “We, more than any other generation, recognize these deeply rooted and systemic inequalities across race, socioeconomic class, and gender and are committed to developing long term and sustainable solutions to change what our parents have allowed to become the norm.”In the meantime, young Americans will have to speak up and come forward in the coming years in order to make amends for some of the effects of the new tax plan. But it seems to be happening already.“We’re already seeing huge numbers of young people signing up to run for office, joining movements that call for accountability,” Brown said, “and demanding change from leaders across politics, business, media, and advocacy.”Get educated on how the tax bill affects you.If you have a strong opinion on how the government should be run, don't just talk about it— take action. Make sure you're registered to vote so that you can have your voice heard. Then show up on Election Day in local and federal races to make your vote count. VICE Impact has partnered with TurboVote to get people registered, sign up today to have an effect on tomorrow.

Advertisement

“Anyone who voted for it is going to have a tough time looking a hardworking young person in the face and argue that this was a good bill for their future."

Advertisement

Check out more videos from VICE:

In addition, deductions for bike commuters have been removed in the new bill, set to take place in 2018. Although not stated in the tax bill, Trump also announced a 30-percent solar panel import tariff at the start of 2018, as well, so young people can look forward to backpedaling environmentally both now and in the future as they continue to deal with possible increases in pollution and climate change as a result.“The tax code needs to be updated to reflect 21st Century America, and should recognize new social norms. The repeal of the tax free bike commuter benefit is a failure to recognize and embrace the decline in car ownership and alternative commuter preferences,” Brown said.

Meanwhile, nonprofits will see a dramatic fallout from the tax bill. Doubling standard deductions removes the incentive for wealthier people to itemize charitable donations, leading to an estimated $13 billion loss. Although the rich are likely to make larger donations they can write off, 87 percent of young people were credited with donating to charity in 2013 as well, more than half of which exceeded $100. But now, any young person donating less than $12,000 doesn’t have any tax incentive to do so.“Young people are essential to this country’s growth and future success, yet face enormous political and social inequality."

Advertisement