From annoying fake delivery texts, to hackers forcing Instagram users to film hostage-style videos of themselves promoting get-rich-quick schemes, 2021 was the year scamming blew up.

As Paul Maskall, fraud and cybercrime prevention manager at UK Finance, puts it: “There’s a flavour of fraud for everyone.”

Videos by VICE

In the first half of 2021, criminals in the UK stole over £750m through fraud – a big portion of which came from online scams. This was an increase of over 30 per cent compared to the first half of 2020 and it doesn’t look to be slowing down. Younger people are also increasingly becoming victims. In the last 12 months, Action Fraud has had more reports from people aged 20-29 and 30-39 than any other age groups.

“Over the last 18 months, criminals have had to adapt online as much as we have in some ways,” says Maskall. As our lives have moved even further online, so too have scams – 80 per cent of cases reported to Action Fraud are now “cyber-enabled”, AKA done using digital devices or the internet. This may account for why we’re falling victim to scams in greater numbers than our nans, who are less likely to be shopping, socialising or investing money online.

Maskall says it’s not just that our reliance on the internet has made us easier targets for scammers; it’s also that technology creates a barrier between scammers and their victims, making it easier for them to steal money and sleep at night. “You’ve got that aspect of the accessibility to commit fraud, but on the other side of the coin you have: ‘I’m increasingly detached from my victim.’”

The way our lives have changed since the start of the pandemic has also made it easier for certain scams to thrive. Jenny Ross, Which? money editor, says that scams were already rising year-on-year in the UK before Covid, but since the pandemic, they have exploded.

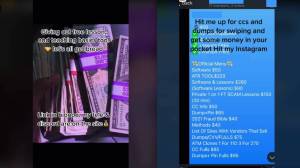

Think about our increasing reliance on buying stuff off the internet. This goes a long way to explaining why online shopping and auction scams were the most reported types of scam this year, with some Tiktok users even selling “scam bibles”, detailing how to exploit Depop’s refund policy and sell on items to make extra cash.

Scams like these shot up by 65 per cent in 2021 and account for one-in-four incidents reported to Action Fraud, with 56 per cent of them coming from 20-39 year olds. “That really speaks to the change in behaviour – so many people were doing their grocery shopping first of all, but ordering all sorts of other bits and pieces as well, making them more vulnerable,” says Ross.

And remember those missed delivery text scams from earlier this year? You probably do – research by Which? showed that three in five of us have received them. They weren’t just a phishing attempt to get you to put your bank details into a website, but also involved a more elaborate reverse-scam. In this, scammers call the victim, then pose as a bank employee and refer to the original phishing text. By convincing the victim they are at threat from a phishing attempt, the scammers get them to transfer money to a bank account they control. While you might have swerved the dodgy texts, some people lost thousands of pounds to them.

Gareth Norris, senior lecturer in psychology at Aberystwyth University says there are a number of factors involved in how and why we fall for these sorts of scams, but timing is key. “They’ve died off now, I’ve not had one for ages, but there will be a new one coming through,” he says. “People will go on to any website because they think there’s this Black Friday deal and enter their details.”

Timing also played a role in the rise of cryptocurrency, NFT and other investment scams in 2021, with some people sinking hundreds of thousands of pounds into them. This year, being openly interested in money has gone from the preserve of London Pride-swilling City boys, to pretty much everyone with access to a finance app and a few spare pounds swimming around.

It’s easy to see why: Bitcoin’s price is three times higher now than it was 12 months ago and interest in trading stocks has also skyrocketed since a load of amateur traders took on Wall Street and inflated the price of “meme” stock, Gamestop, back in January.

Ross says that while this new excitement over investing could be a good thing for getting younger people interested in their finances, it has also made it easier and more likely for people to buy into things they might not fully understand – a perfect situation for scammers to exploit.

“It’s bringing about something of a Wild West in investment,” she says. “Via Tiktok or various social channels, anyone can pop up and present themselves as a finance guru or expert and people are taking their word for it.”

All three of the experts interviewed in this article agreed that social media use has driven people’s fear of missing out on investment opportunities. They say the growing trend of people handing out financial tips and showing off their supposed profits in communities such as FinTok has increased impulsivity, making people less likely to think properly before entering into both legit investments as well as scams.

Excitement over crypto and NFTs has led people to jump on even the most absurd and unlikely sounding “investments”. While some meme currencies have grown in value over time, others seem to pop up out of nowhere and vanish even quicker than that, in what are known as rug pull scams. These are where a cryptocurrency or NFT’s developers hypes up its product, attracting investors, before running off with the funds and crashing the product’s value in the process. So far, rug pulls have taken in investors on ape NFTs as well as cryptocoins based on Squid Game and even monkey jizz.

Norris questions to what degree some of these can even truly be considered scams – and says in some cases there’s almost an element of people wanting to get taken in by them. The rise of these meme investment opportunities is built on the back of internet irony and nihilism. If you are chucking money into a product called monkey jizz, or investing in a cryptocurrency with no real purpose, can it really be that shocking when everything vanishes? “There’s a difference between unwittingly falling for something and whether you have taken a risk,” Norris says.

The pandemic has left us more detached – both from reality and each other – and the saddest result of that might be the rise in romance scams, with online dating cons up 41 percent over the pandemic. A popular one this year has involved fake Tinder accounts matching with people, striking up romantic conversation, and luring them into chucking money into nonexistent cryptocurrencies.

Maskall says that just like other scams, these take advantage of the narrative we feed ourselves when we interact online. We believe what we want to believe and we read things in the way we want to read them. Whether you’re lonely and want to find someone to love you, or you are trying to make quick cash on a cryptocurrency that turns out not to really exist, scammers are able to capitalise on our anxiety more than ever.

“You project a lot of your emotions, your expectations, on to technology,” he says. “That goes the same for everything – why does fake news have such an impact? Why do we feel we are in such a polarised society right now? Because you don’t have opposing feedback to bring you back down to earth, especially around that story you are telling yourself.”

More

From VICE

-

Peter Cade/Getty Images -

Illustration by Reesa -

Daniel Garrido/Getty Images -

(Photo by Alexander Pohl/NurPhoto via Getty Images)