The chemical makeup of naloxone has been known since 1961; it’s an old and cheap life-saving drug that can quickly reverse an opioid overdose. But Evzio, a naloxone auto-injector made by pharmaceutical company Kaléo, has regularly undergone dramatic price increases, at one point costing $4,500 for a two-pack. Because of its steep cost, insurance companies often require submission of prior authorization requests before they approve coverage for it—putting it out of reach for those who might need it.

It’s a common story in the U.S.: An old and cheap drug was transformed into an expensive, inaccessible product. This happened through patents, legally granted rights to exclude others from making or selling an invention. Kaléo has 25 patents on Evzio in total, the latest of which expires in July 2034.

Videos by VICE

What exactly did Kaléo invent? “A closer look reveals that not only are the patents overlapping, rather than distinct, but that nine of the inventions have the exact same name and are part of the same patent ‘family,’ covering modified versions of the same invention with slightly different dates of expiration,” wrote Colleen Chien, a law professor at Santa Clara University School of Law, in a 2022 paper titled “The Inequalities of Innovation.”

Kaléo isn’t doing anything very special with Evzio. It’s using patents as many companies, especially drug companies, have for decades. While patents were intended to encourage innovation, that’s not always how it works in practice, especially when it comes to medicine. Instead, patents are used to extend ownership over inventions well beyond a period of initial exclusivity, creating monopolies and driving up drug prices.

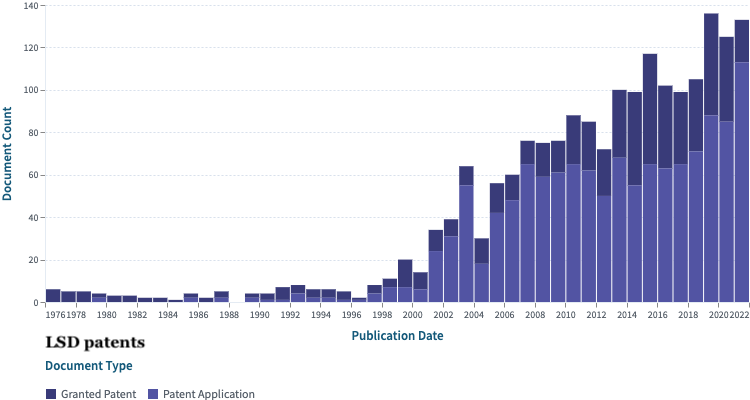

These glaring issues with the patent system should be a concern for the emerging psychedelic industry, which is entering into the world of patenting at scale for the very first time. In 2016, the psychedelic patent landscape was, according to one psychedelic CEO, “wide open.” But no longer. Hundreds of psychedelic patents are being filed, and many granted, with hundreds still secret since patent applications aren’t made public until 18 months after filing.

In the short time that psychedelic drugs have received attention from start-up companies and venture capitalists, there have already been problematic patents. Patents are supposed to be granted on inventions that are new, and not obvious to someone in a given field. But just like in other areas of pharma, we’ve seen patents and patent applications on “inventions” that academics say they have already published about, on products that people have used in recreational settings for years, on minute modifications to molecules used for thousands of years, on rudimentary aspects of psychedelic-assisted therapy, and on uses for psychedelics that have never been tested.

Perhaps this shouldn’t come as a surprise, not because of psychedelics, but because of the problems with the patent system as a whole. For decades, advocates have been ringing alarm bells about bad patent practices. In April, the New York Times editorial board published an opinion piece titled “Save America’s Patent System.” “Put simply: The United States Patent and Trademark Office is in dire need of reform,” the board wrote.

There is now, potentially, a patent reckoning. There is a new United States Patent and Trademark Office (USPTO) director, after the organization was absent a leader for over a year. In 2021, President Biden called for the FDA and the USPTO to work together to understand the scope of the problem of drug pricing, and address solutions. And there’s been widespread attention on how the patents on the COVID-19 vaccines impeded global access.

The patent system is a stark example of how, even if medical psychedelics could be beneficial to some people for some uses, the process of implementing these treatments requires working within deeply flawed existing structures. It would be wrong to assume that psychedelic companies, because they deal in psychedelics, will be immune to those flaws.

The psychedelics industry is maturing. Initially, venture capital (VC) groups dedicated to psychedelics were providing most of the funds, but as Yeji Jesse Lee recently reported in Business Insider, mainstream healthcare VCs are now entering the market. With FDA approval for psilocybin and MDMA looming, it’s reasonable to guess that larger pharmaceutical companies will follow eventually. Many psychedelic companies are already boasting about building up their IP portfolios, or their “aggressive patent estates.” In audio shared with Motherboard from an investor meeting in April, executives from the mental health company Compass Pathways and Atai Life Sciences discussed patent strategy.

“You obviously give it to the lawyers and say, make it as broad as possible because, you know, some things are taken out in the approval anyway,” said Christian Angermayer, the founder of Atai.

Psychedelic companies can choose to position themselves within existing structures, maintaining the current state of affairs. There is an opportunity, though, for a new industry—one that claims to exist for the sake of improving well-being and at its most grandiose claims to be capable of ushering in utopia—to be part of the call for patent reform. Psychedelics cannot foster a “revolution” in well-being if they replicate the abuses of power and inequities that already exist in our world. Psychedelics could better the systems they enter into, rather than just playing by their rules.

“With a new industry, like psychedelics, we are setting the pathway for the future,” said Robin Feldman, a professor of law and the director of the University of California Hastings Center for Innovation. “Improper patent behavior now can determine the direction of this industry: Access for patients, or the ability of generics to enter for a long period of time.”

Patents are meant to promote innovation by restricting competition for a limited period of time. In the pharmaceutical industry, patents are meant to give companies incentive to undertake financially risky research and development. In return for doing so, the reward is that they get to exclude others from using the innovation and make back their, and others’, investment.

“I’m definitely not a person who would say, ’No patents anywhere,’” Feldman said.

The problem isn’t with patents; it’s with how patents have been used and abused. Eventually, a patent is supposed to expire so there can be broader use of that invention. In pharmaceuticals, that means generic versions, which “is really the only known mechanism to meaningfully lower drug prices,” said Ameet Sarpatwari, an epidemiologist and lawyer at the Harvard Medical School Center for Bioethics.

The drug industry, which psychedelics are hoping to join, comprises some of the worst patent offenders. Feldman’s research found that 78% of drugs associated with new patents between 2005 and 2015 were not actually new. If patents are supposed to drive innovation, that’s not what happens in practice. Focus shifts from developing new, transformative drugs to trying to develop modifications to existing drugs to secure patents. “Not all inventions add that much to what we can already do,” said Lee Vinsel, an associate professor of science, technology, and society at Virginia Tech and the co-author of The Innovation Delusion.

Watch more from VICE:

Similar trends are already at play in psychedelics, with companies filing and getting applications for minute modifications in known or existing molecules, like, to take just two examples of many, a patent for a different solid crystal form of psilocybin, or a deuterated version of psilocybin, which is the same molecule except with slightly different hydrogen atoms.

“There are clear cases where patents protect innovation, but those tend to be a relatively small number of patents,” said Jim Bessen, an economist at Boston University, and the author of Patent Failure. “It’s about building up moats that companies can use to protect markets, and protect whole classes of ideas.”

What companies do (if they can afford it) is build large patent portfolios so that they can threaten to sue and counter-sue others. For the top-grossing 12 drugs in the US, there are 125 patents filed, and 71 granted patents, per drug. Over half have more than 100 attempted patents per drug. These are called patent thickets: When a company creates a thick bramble of patents to keep competitors and generics out.

The threat of litigation from patents can cause others to reduce or divert R&D spending. In 2019, research found that when there are an increasing number of patents in a given field, startup inventors reduce their research and development spending.

The company AbbVie has filed more than 250 patents on Humira, its rheumatoid arthritis drug. “A lot of patents are arguably on peripheral aspects of molecules that are less innovative than the chemical entity itself,” said Bhaven Sampat, an economist at Columbia University, who studies the effects of patents on innovation, prices, and access to medicines. It’s sometimes called “life cycle management,” which means extending the protections around a product into the distant future. The more pejorative term would be “product hopping” or “evergreening.”

“It shows how the real innovation that’s coming out of some of these companies is coming from the legal department, not from the scientists,” Sarpatwari said.

There’s a seemingly endless pit of examples of bad patent practices related to drugs. Companies often make slight modifications to a drug’s dosage or delivery mechanism just before the patent expires and then shift the market to the version that’s protected by new patents, Feldman said. When the patents were nearing expiration for the colitis drug Asacol, for example, the company developed and introduced Delzicol, which was just an Asacol tablet surrounded by a cellulose capsule.

“If the capsule was cut open, the original Asacol tablet fell out,” Feldman said. “Even the FDA agreed that the two drugs were completely the same. But the company still got a shiny new patent.” Then, the company removed Asacol from the market, redirecting patients only to the drugs it had new patents on.

The drug Revlimid, from drug manufacturer Celgene, is an analogue of thalidomide, a drug that caused birth defects when given to pregnant people in the 1950s and 60s. It was repurposed as a cancer treatment, but the company had to set up a safety protocol to use it, so that no pregnant person would take the drug.

Celgene then patented its safety plan. When a generic company applied for approval, Celgene filed a citizen petition asking the FDA to deny the application. Celgene said that no generic could use its safety plan because it owned it, and since there was no other way to ensure safe use of the drug, this ensured their monopoly on it.

This is directly relevant to psychedelics because it’s possible the FDA could approve psilocybin or MDMA with a set of safety instructions, called a Risk Evaluation and Mitigation Strategy (REMS). A company with a patent around mandatory safety practices could thus own the therapy.

Over the past two decades, patents have been used to forestall competition, which resulted in raised drug prices. Humira, the rheumatoid arthritis drug, has 132 granted patents attached to it, 90 of which were issued 12 years after the drug came out. These patents aren’t just directed to the drug itself but to “ingredients and formulations AbbVie anticipated its competition might seek to employ.” The drugs gross over $12 billion in U.S. sales per year which, as the non-profit Initiative for Medicines, Access & Knowledge noted, is “more money annually than all of the NFL teams, combined.”

To get those patents, AbbVie used “prophetic examples”—meaning they guessed on experiments and made up data that others might one day want to do or use, and got patents on those fictitious examples. We’ve already seen prophetic examples used in psychedelic patents, like in a granted patent for LSD for food allergies, despite the fact that no clinical research has been done on that topic.

“Though a number of AbbVie’s patents have proven to be invalid, each challenge is costly,” Chien wrote. “Rather than try to cut through the thicket, competitors have in some cases settled with AbbVie translating into delayed dates of generic entry.”

Starting to see psychedelic patents follow in these other patents’ footsteps should be alarming, said Sarpatwari. “It should be surprising and concerning that people who have been in the field for decades are seeing companies come in and get patents for what seem to be very obvious modifications,” he said. “This is a problem with our patent system and it’s a pronounced problem in the pharmaceutical industry.”

We can hope that the psychedelic industry will be different. But the patent system has proven that it allows this behavior, and that those who partake in it reap financial rewards. That gives anyone participating in the system an incentive to do the same.

In audio of an investor meeting from April that was shared with Motherboard, executives from the mental health company Compass Pathways and Atai Life Sciences discussed the company’s patent strategy and philosophy.

George Goldsmith, CEO and co-founder of Compass, said that early on, the company looked to patent successes to shape their own actions. Specifically it turned to GW Pharmaceuticals, a British pharma company, that took “CBD and THC into different development paths and they patented their approach to this.”

“Our first port of call was who did that and who was successful and able to get those initial patents,” Goldsmith said, adding that Compass sought out the same counsel for its patents on synthetic psilocybin. Compass currently has 10 patents, five in the US, and Goldsmith said, “We have quite a number of others that we’re developing.”

Christian Angermayer, the CEO of Atai and a funder of Compass, asked if anyone else could synthesize psilocybin the way Compass does it. George responded that, “No one else can do it without violating our patent.” (In an email obtained by Motherboard from last year, Angermayer similarly wrote, “Many psychedelic companies out there will never be able to bring a product to market, as they will hit the patents of Compass and Atai.”)

In the meeting, Angermayer also said, when describing patent strategy more generally, that the directive to lawyers would be to make claims “as broad as possible.” When reached, Compass did not have additional comments to add.

As patent lawyer David Casimir previously told Motherboard, it’s not unusual for patent applications to include extremely broad claims, even if applicants know they are not patentable. Once patent examiners respond, an application can be amended with narrower claims, but this process might allow claims that examiners don’t catch to slip through. “This can lead to bad patents,” Casimir told Motherboard. “If the patent office doesn’t do a good job, then they’ll say, ‘Okay, you can have this broad claim.’”

Though Compass has had the most attention directed to its patents, this mentality is not unique. Besides filing broad applications, filing patents on small modifications to known molecules, “novel” delivery systems, or different solid forms is abundant in the field. “The top five public psychedelics companies by market cap—Atai Life Sciences, Compass Pathways, GH Research, MindMed, and Cybin—have submitted or already own the rights to at least 157 patents,” as Lee has reported. And since most psychedelic companies were founded in the early-to-mid 2020s, many patents are still undisclosed; there are hundreds we don’t know about. This threatens to create patent thickets very early on in the industry.

Money plays a key role here in another way: We want psychedelics to be put through clinical trials, and someone needs to pay for it. Rigorous testing is necessary to learn whether psychedelics truly can be treatments for conditions like PTSD, depression, or addiction, and so that patients know that what they’re signing up for, in the medical context, has efficacy and safety data backing it.

One reason for the predominant role patents are already playing in psychedelics is the lack of federal funding for such research, which has pushed nearly the entire field into privately-owned companies. It’s also partly due to the Drug Enforcement Administration’s scheduling of psychedelic compounds as Schedule 1, which makes research logistically difficult.

“Using public sector funding to develop these products is another reasonable policy approach that might avoid some of the patent tradeoffs,” Sampat said.

But barreling ahead with VC money, patents, and ROI alone opens up the field to the systemic problems with the patent system. For instance, a patent examiner can’t ever really reject a patent. They can reject an application, but the applicant can then file what’s called a “continuation” and go through the whole process again.

Then, the applicant can change the words within the patent—even if the invention remains the same—and keep filing it until it gets granted. People with the most capital are the ones able to do this, widening the gap between who is able to get psychedelic patents and who isn’t. Companies can also file continuations when they see a competing product coming onto the market, and they can tweak an application so it covers that product and sue the other party.

This is just one way in which patents can also reinforce pre-existing inequalities before a drug is even approved. Who has the money to lawyer up and file for these patents? According to Chien’s research, in 2020 over half of new U.S. patents went to the top 1% of patentees, and more than half of all U.S. patents of U.S. came from five states, all coastal. Less than 13% of inventors were women. When researchers looked at how patenting affected income inequality between 1980 and 2015, they found that increase in patenting was correlated with increases in “top income inequality,” meaning patents helped the rich get richer.

Alongside the medical pipeline, psychedelics are also being decriminalized and in some places legally regulated by states. This creates a unique situation where if psychedelic treatments are inaccessible in the medical model, people might turn to legal or decriminalized alternatives.

This isn’t the case for pharmaceutical drugs, so we don’t know how legal competition will affect medical psychedelics. But while psychedelics can be used for many purposes— recreational, spiritual, or general well-being—there are reasons to want to ensure that people who prefer medical psychedelics can choose that if they want to, rather than have people be priced out of certain options.

People seeking out psychedelics for mental health indications may wish to see providers with expertise in those conditions, and be protected by medicine’s accountability frameworks of practitioner licensing and malpractice insurance. Though it’s unclear whether and how insurance companies will cover psychedelic-assisted therapy, insurers definitely won’t reimburse psychedelic care accessed outside the medical model.

For those in communities where psychedelic drugs still carry a lot of stigma, they might only be comfortable trying these treatments by getting a prescription for an FDA-approved medication. Too many broad patents too soon, and bad patent practices will threaten the cost and accessibility of care.

“You basically get a two-tiered society, which we already have, but this exacerbates that,” Sarpatwari said.

The last meaningful attempt at patent policy reform was in 2014, when the Patent Transparency and Improvements Act, which would have made a number of reforms to how patents are used, was pulled from the Senate agenda.

Experts Motherboard consulted said that the demand for reform is currently strong again. The patent office hasn’t had a permanent director for the past year, but the Senate recently confirmed Kathi Vidal, a Silicon Valley patent attorney to lead the USPTO. (She did not respond to requests for an interview.)

There has been some pushback on psychedelic patents, like from the nonprofit Freedom to Operate, and through the creation of Porta Sophia, a psychedelic prior art repository. But Tahir Amin, a lawyer and co-founder of Initiative for Medicines, Access & Knowledge (I-MAK), doesn’t think that challenging patent by patent, or even drug by drug, can successfully address the larger, systemic concerns. Who has the resources to spend to challenge those patents? As Motherboard has reported, it cost nearly a million dollars for Freedom to Operate to challenge two of Compass Pathways’ psilocybin patents.

What’s needed are new policies around what patents are actually allowed, Amin said. It’s not shocking that companies act in their own interest, Feldman said. “We can’t expect them to act in any other way if we want to curb this behavior,” she said. “Our government has to change the incentives in the system and the opportunities for behavior that’s bad for consumers.”

There are a number of basic reforms that Priti Krishtel, a lawyer and co-founder of I-MAK, said could help with patent misuse. Officials could make it easier and cheaper to challenge patents, and require that certain secondary pharmaceutical patents be forced to undergo a review. There could also be a maximum to the amount of times an applicant can resubmit their application.

Patent examiners could be given more time to review applications. It’s been shown that even very complex applications on average get 19 hours of review; some get much less. (Like the granted patent for a DMT vape pen where the examiner only looked for prior art for seven minutes.) Chien has written that licensing patents or donating them to the public domain could be rewarded with tax breaks. She is also researching now whether there are ways to predict risky patents before they get granted, by identifying patents that have a lot of legal heft behind them.

For years, advocates and academics have been raising concerns about bad patent practices and how they affect drug prices, access, and social equality. These are immense resources and experts that the psychedelics industry should be collaborating with and turning to. For if the psychedelic industry establishes itself on a bedrock of broad and secondary patents now, it’s unclear what effect that might have on the future of these treatments.

After decades of huge revenue growth, branded pharmaceuticals began to lose money around 2009 in what’s been called the “patent cliff,” when patents began to expire and people began to produce and buy generics instead. In response, companies started to raise prices to make up for the revenue. Will companies getting psychedelic patents now let their patents expire in 20 years, and let generics enter the market? Or will companies engage in the practices that are common in pharma right now, which could have implications on cost and access for decades to come? “Patent trolls” are another blight in the current patent system: entities that use patents to sue others for profit, rather than developing products themselves. It’s too early in psychedelics for such trolling, but as companies go out of business, what will happen to their IP? Will they try to recoup investment by litigating against others?

People in psychedelics are often posturing about how these compounds will make the world a better place. “Psychedelics are one of the rare cases where profit and impact work together synergistically,” Tim Schlidt, the co-founder and partner of VC fund Palo Santo said in a recent interview with TechCrunch. Filing patents as business as usual runs counter to that ethos.

Feldman agreed that it’s an important moment for patent reform. The psychedelics industry just so happens to be maturing at the same time. Whether or not psychedelic companies will adhere to the status quo or take advantage of the need for change is yet to be seen.

Follow Shayla Love on Twitter.

More

From VICE

-

Screenshot: Pokemon Go -

Clara Balzary -

Screenshot: NetEase -